Get Form 886 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 886 A online

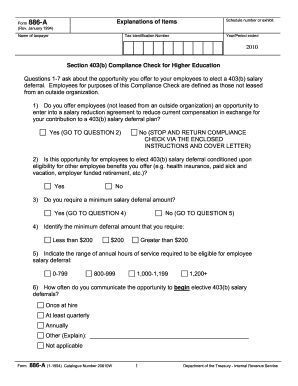

Filling out the Form 886 A is essential for ensuring that your organization complies with federal regulations regarding 403(b) salary deferral plans. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the Form 886 A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the taxpayer in the designated field.

- Next, input the Tax Identification Number (TIN) associated with the taxpayer.

- Fill in the year or period ended, ensuring it reflects the appropriate tax year.

- Address questions 1 through 7 regarding the opportunities for employees to elect a 403(b) salary deferral. For each question, select the appropriate response and provide any required explanations.

- Move on to questions 8 through 12, which pertain to the after-tax Roth 403(b) salary deferral opportunities. Again, read each question carefully and answer as applicable.

- Continue with questions 13 through 18 to provide information about any residency programs and groups of employees excluded from electing 403(b) salary deferrals.

- Finally, respond to questions 19 through 21 regarding the existence of a written plan document that outlines your 403(b) salary deferral plan.

- Review all responses for accuracy and completeness. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Complete your documents online to ensure compliance and facilitate your filing process.

The point of form 8606 is to report non-deductible contributions to traditional IRAs and to provide information about distributions from Roth IRAs. This form ensures that taxpayers keep accurate records of their contributions, preventing unnecessary taxation on funds that have already been taxed. Properly filing form 8606 can help you manage your retirement savings effectively. If you require assistance, US Legal Forms can guide you through the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.