Get Jessamine County City Of Nicholasville Net Profit License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Jessamine County City Of Nicholasville Net Profit License Fee Return online

This guide provides clear instructions on how to complete the Jessamine County City Of Nicholasville Net Profit License Fee Return online. Whether you are a first-time filer or need clarification on specific sections, this guide supports you in navigating the process effortlessly.

Follow the steps to fill out the return accurately.

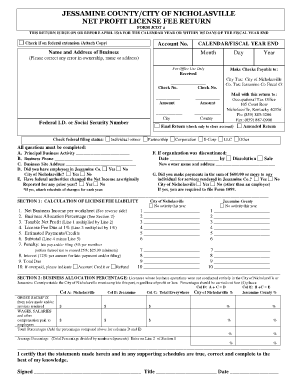

- Click ‘Get Form’ button to access the net profit license fee return form and open it for editing.

- Begin by filling in your account number at the top of the form to identify your business with the city.

- Indicate the calendar or fiscal year end date for which you are filing, ensuring it aligns with your financial records.

- Enter the name and address of your business. Correct any inaccuracies in ownership or address to avoid processing issues.

- Indicate if you are on a federal extension, and if so, attach a copy of the extension documentation.

- Provide details such as federal I.D. or Social Security number, principal business activity, and business phone number.

- Answer the questions regarding employment in Jessamine County and the City of Nicholasville. Specify if federal authorities have changed your reported net income for any prior year.

- Complete Section 1, beginning with calculating your net business income. Use the worksheet provided on the reverse side for assistance.

- Calculate the business allocation percentage and apply it to your net business income to determine the taxable net profit.

- Assess the total license fee due at 1% and account for any estimated payments or credits. Calculate the total due after subtracting any payments from the fee.

- If applicable, indicate any penalties for late payment and interest for late filing, ensuring all calculations are accurate.

- In Section 2, calculate your business allocation percentage if your business operations extend beyond the City of Nicholasville and Jessamine County.

- Once all fields are completed, review the form for accuracy. Ensure your signature, title, and date are included at the bottom of the form.

- After finalizing the form, you can save your changes, download, print the document, or share it as needed.

Start completing your Jessamine County City Of Nicholasville Net Profit License Fee Return online today!

All limited liability entities operating in Kentucky that meet the gross receipts threshold must file the LLET. This includes corporations and LLCs, regardless of their legal structure. To simplify the filing process and ensure compliance with the Jessamine County City Of Nicholasville Net Profit License Fee Return, consider using platforms like uslegalforms for guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.