Get Form 1019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1019 online

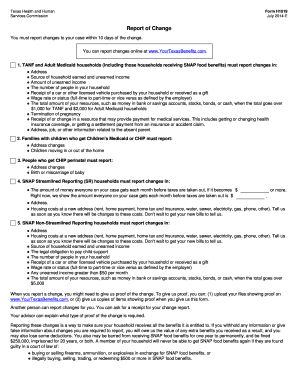

Form 1019 is designed to help you report important changes to your case regarding benefits such as TANF, Medicaid, and SNAP. Accurately completing this form ensures that your household receives the appropriate assistance and adheres to the reporting requirements.

Follow the steps to complete the Form 1019 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in your name and case number at the top of the form. This information is crucial for identifying your case.

- Indicate the changes you need to report by providing the date of each change and a brief explanation in the designated section.

- For each change reported, attach any proof that supports your claim. This may include documentation such as pay stubs, bills, or official statements.

- Specify how long you expect each change to last in the provided field.

- Sign and date the form in the appropriate fields, ensuring it is signed by the person reporting the change.

- After completing the form, you can save your changes, download a copy for your records, print the document, or share it as needed.

Complete and submit your Form 1019 online today to ensure your benefits are accurately managed.

Form 1024 is a document used by Texas Health and Human Services to assess and process applications related to various health services. It primarily focuses on determining eligibility for services and benefits under state programs. While this form is crucial for health-related assistance, it's important to distinguish it from Form 1019, which pertains to tax matters. If you need guidance on navigating these forms, USLegalForms offers resources to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.