Loading

Get Pta Cash Count Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pta Cash Count Sheet online

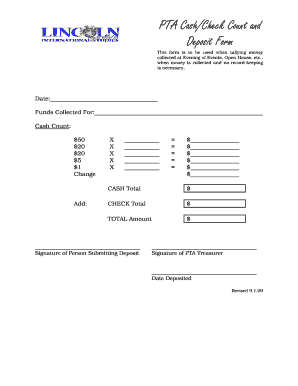

The Pta Cash Count Sheet is a crucial document used for tallying funds collected during events such as Evening of Events or Open House. Accurately completing this form ensures a clear record of financial transactions.

Follow the steps to fill out the Pta Cash Count Sheet online.

- Press the ‘Get Form’ button to acquire the Pta Cash Count Sheet and open it in the editing interface.

- Enter the date in the designated field. This should reflect the actual date when funds were collected.

- In the 'Funds Collected For' section, specify the event from which the funds were raised (e.g., Evening of Events, Open House).

- Proceed to the 'Cash Count' area, where you will input the quantities of different denominations collected. Fill in the appropriate quantities for $50, $20, $5, $1 bills, and any change you may have.

- After entering the quantities, calculate the total cash collected for each denomination. Write the totals in the corresponding fields next to each denomination.

- Add all cash totals together to find the overall 'CASH Total', writing this amount in the designated space below the individual counts.

- Next, enter the 'CHECK Total' amount collected. Ensure this figure is accurate and represents all checks received.

- Calculate the 'TOTAL Amount' by adding both the 'CASH Total' and 'CHECK Total'. Write this final amount in the provided section.

- At the bottom of the form, include your signature as the person submitting the deposit, followed by the signature of the PTA Treasurer who will authorize the transaction.

- Finally, record the date you are depositing the funds in the respective field.

- Once you have completed all sections of the form, save your changes, and you can choose to download, print, or share the completed form as necessary.

Start filling out your Pta Cash Count Sheet online today for seamless financial tracking.

Related links form

To fill out a cash book, start by recording the date of each transaction. Next, document all cash inflows and outflows, categorizing them appropriately for better tracking. Regularly update the cash book to reflect the current cash balance, which is crucial for financial accuracy. Utilizing tools from uslegalforms can help streamline this process with user-friendly templates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.