Loading

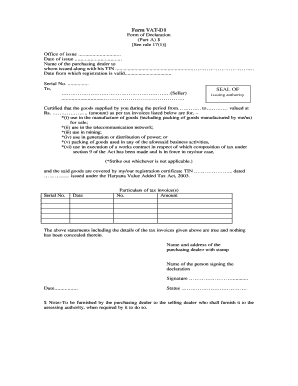

Get Form Vat-d1 .............................. .. Seal Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form VAT-D1 online

Filling out the Form VAT-D1 is essential for purchasing dealers to document goods supplied under specific tax guidelines. This guide provides straightforward steps to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the VAT-D1 form.

- Click the ‘Get Form’ button to obtain the VAT-D1 form and open it in the online editor.

- Fill in the 'Office of issue' field with the appropriate issuing authority's name.

- Insert the 'Date of issue' to indicate when the form is being issued.

- Provide the 'Name of the purchasing dealer' along with their Tax Identification Number (TIN) in the next section.

- Enter the 'Date from which registration is valid' to specify the effective date of registration.

- Complete the 'Serial No.' field by assigning a unique number for reference.

- Address the section designated for the seller, ensuring to enter the seller's name correctly.

- Under the SEAL OF section, add any official seal if required by your issuing authority.

- Fill in the declarations regarding the goods' use, striking out any options that do not apply.

- Document the Serial Number and Date under Particulars of tax invoice(s) and fill in the respective amounts.

- Confirm the accuracy of your statements, ensuring that nothing has been concealed.

- Sign the declaration where it asks for the name and signature of the purchasing dealer.

- Once completed, save your changes, and utilize options to download, print, or share the form as necessary.

Complete your Form VAT-D1 online today to ensure compliance and proper documentation.

Form D-1 means that those material purchased by purchaser only used for manfucaturing, packing, works contractor etc and form C-4 means sales has been deposited the sales tax against issued invoices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.