Loading

Get Certified Payroll Form (pdf) - Uc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certified Payroll Form (PDF) - Uc online

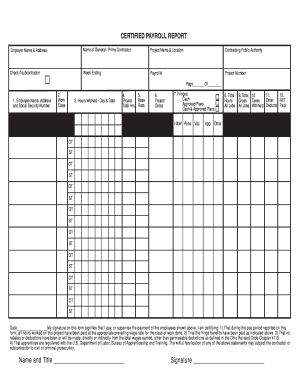

Filling out the Certified Payroll Form is an essential process for employers involved in projects funded by public authorities. This guide provides clear and supportive instructions to help users navigate the various sections of the form online.

Follow the steps to accurately fill out the Certified Payroll Form

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the employer name and address at the top of the form. This information identifies the entity responsible for the payroll.

- Enter the name of the general or prime contractor involved in the project. This ensures accountability for the payroll process.

- Fill in the project name and location to specify the work being reported.

- Identify the contracting public authority associated with the project.

- Indicate the week ending date for the payroll being reported.

- Record the project number, if applicable.

- Specify the work class for each employee, detailing the type of work they performed.

- In the base project section, record the total hours worked and the rate of pay for each employee.

- Calculate the gross pay for the project by summing each employee's earnings.

- Total the hours across all jobs for a comprehensive view of employee contributions.

- Complete the sections for taxes withheld, other deductions, and net pay, ensuring all figures are accurate and reflective of actual amounts.

- Once the form is complete, you can save changes, download, print, or share it as needed.

Complete your Certified Payroll Form online to ensure compliance and streamline your reporting process.

Certified payroll can be completed by project owners, contractors, or designated personnel familiar with payroll processes. However, it is crucial that the individual responsible understands the compliance requirements tied to the Certified Payroll Form (PDF) - Uc. Using platforms like uslegalforms can simplify the process, providing templates and guidance to ensure accuracy and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.