Loading

Get Ri Tx 17

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Tx 17 online

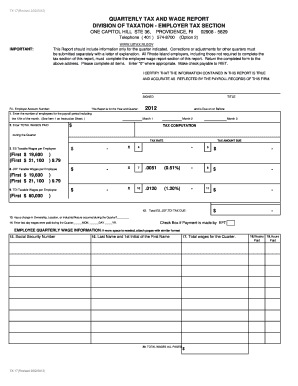

The Ri Tx 17, or the Quarterly Tax and Wage Report, is a critical document for Rhode Island employers to accurately report their employee wages and tax contributions. This guide provides a step-by-step approach to help you fill out the form online effectively.

Follow the steps to complete the Ri Tx 17 online.

- Press the ‘Get Form’ button to access the Ri Tx 17 form and open it in your online editor.

- Indicate the number of employees for each month of the quarter. Input the full-time and part-time workers who performed services during the payroll period that includes the twelfth of the month. If no employees worked, enter '0'.

- Input the total wages paid during the quarter for each month. This includes all compensation whether in cash or kind, like benefits. Ensure this total is consistent with the amount listed in Item 20.

- Calculate the Employment Security Taxable Wages per Employee based on the capped amounts for the year. Enter these in the designated fields, noting the applicable tax rates.

- Compute the total Employment Security, Job Development Fund, and Temporary Disability Insurance taxes due by multiplying the taxable wages by the corresponding rates.

- If there were any changes in ownership, location, or industrial nature, respond appropriately in the provided section.

- Document the last day wages were paid during the quarter.

- Complete the employee wage information section by listing each employee's Social Security number, last name, first initial, total wages, the number of weeks paid, and hours worked during the quarter.

- In the final section of the form, ensure all totals agree, especially the amount entered in Item 20. This figure must align with the wages reported.

- Review the completed form for accuracy, ensure it is signed by a responsible party, and then save changes, download, print, or share the form as necessary.

Complete the Ri Tx 17 form online today to ensure compliance with Rhode Island tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 941 is required for employers who withhold income taxes, Social Security, or Medicare from employee wages. This form must be filed quarterly to report tax liabilities and payments. If you're unsure about your obligations regarding Form 941 or need assistance in filling it out, US Legal Forms has resources that can help streamline your filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.