Get Soc 2298 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Soc 2298 Pdf online

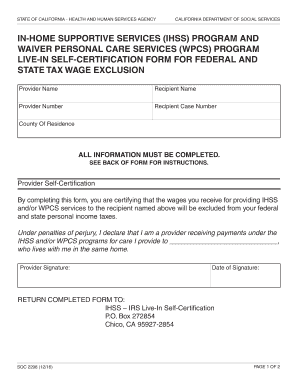

Filling out the Soc 2298 form can be straightforward with the right guidance. This document serves as a self-certification for providers in the In-Home Supportive Services program, ensuring their wages are excluded from federal and state personal income taxes.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to access the Soc 2298 Pdf and open it for editing.

- Enter your provider name in the designated field as it appears on your IHSS paperwork. This ensures your identification aligns with official records.

- Locate your provider number from your IHSS paperwork and input it in the specified area. This number is often found on documents such as the Provider Notification of Recipient Authorized Hours and Services or Timesheets.

- Input the recipient case number in the provided field, ensuring accuracy by retrieving this number from your related IHSS paperwork.

- Enter the county of residence for both you and the recipient in the appropriate section. It is important that this is correctly filled out for processing.

- Review the entire form for completeness and accuracy. Make sure all sections are populated and that the information is clear.

- Sign the form on the designated line. Your signature serves as your certification of the information provided.

- Date the form in the designated area after signing.

- Ensure you are using black ink and print clearly throughout the form.

- Once you have filled out the form, double-check for any wrinkles or staples, as these may cause processing issues.

- Save your changes, and consider downloading, printing, or sharing the completed form as needed for submission.

Complete your Soc 2298 form online today to ensure your wages are correctly excluded from taxes.

Self-certification forms are typically required by agencies or organizations that manage assistance programs, like IHSS. These forms help determine eligibility and ensure compliance with program guidelines. If you're unsure about the requirements, visiting UsLegalForms can provide you with resources and templates. For comprehensive details, check out the Soc 2298 Pdf for specific regulations related to self-certification.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.