Get Acs Support Stop 5050

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Acs Support Stop 5050 online

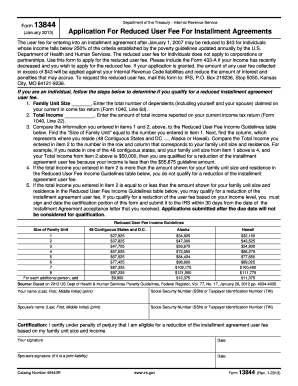

This guide provides clear instructions on how to complete the Acs Support Stop 5050 form, enabling users to apply for a reduced user fee for installment agreements. The form is designed to support individuals in qualifying for a lower fee based on their income and family size.

Follow the steps to fill out the Acs Support Stop 5050 form accurately.

- Press the ‘Get Form’ button to access the Acs Support Stop 5050 form and open it in your preferred online platform.

- Enter your name, including your last name, first name, and middle initial, in the designated field.

- Provide your Social Security Number (SSN) or Taxpayer Identification Number (TIN) in the specified area.

- If applicable, enter your spouse's name, including their last name, first name, and middle initial.

- Complete the field for your spouse's Social Security Number (SSN) or Taxpayer Identification Number (TIN), if you are filing jointly.

- In the first section, input the total number of dependents claimed on your current income tax return (refer to Form 1040, Line 6d).

- Next, enter the amount of total income reported on your current income tax return (referring to Form 1040, Line 22).

- Compare the number of dependents and total income you provided with the Reduced User Fee Income Guidelines table included in the form.

- Determine your eligibility for the reduced user fee based on your family size and income compared to the guidelines.

- If you qualify, sign and date the certification section of the form, confirming your eligibility for the reduced fee.

- Submit the completed form to the IRS within 30 days from receiving the Installment Agreement acceptance letter.

- After submitting the form, you can save changes, download, print, or share the completed document as needed.

Complete your documents online now to ensure you meet the filing requirements.

Related links form

Filling out a form for a stimulus check involves providing accurate personal and financial information. Start by gathering necessary documents such as your Social Security number and income details. Follow the instructions on the form carefully to ensure a smooth process. If you have questions regarding Acs Support Stop 5050 while filling out the form, seeking help from uslegalforms can provide clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.