Get Form 1099 S

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099 S online

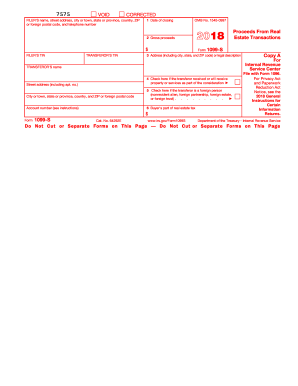

Form 1099 S is essential for reporting proceeds from real estate transactions to the IRS. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently online, ensuring all necessary information is reported correctly.

Follow the steps to complete the Form 1099 S online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the filer's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the corresponding fields.

- In Box 1, input the date of closing for the real estate transaction.

- Fill in Box 2 with the gross proceeds from the transaction, reflecting the total amount received (this includes cash and notes). Remember, this does not include the value of other property or services.

- Provide the address or legal description of the property being transferred in Box 3.

- If applicable, mark Box 4 if the transferor received or will receive any property or services as part of the consideration.

- Check Box 5 if the transferor is a foreign person, which includes nonresident aliens and foreign entities.

- In Box 6, list the buyer's part of the real estate tax.

- Review all entered information for accuracy and completeness before finalizing your submission.

- After verifying the information, save your changes, and proceed to download, print, or share the completed form according to your needs.

Start completing your Form 1099 S online today to ensure compliance with IRS reporting requirements.

Certain individuals and organizations may be exempt from receiving a Form 1099 S. Generally, these exemptions include government entities, non-profit organizations, and transfers of property that do not involve sales. Additionally, if the transaction falls under specific thresholds or conditions, you may not need to file this form. Always consult a tax advisor to confirm your exemption status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.