Loading

Get Annexure S10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annexure S10 online

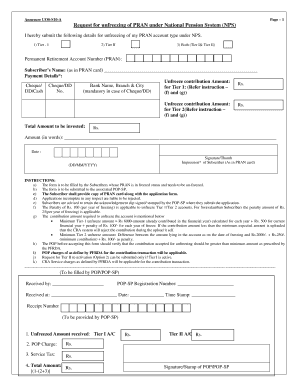

This guide provides clear instructions on how to complete the Annexure S10, which is used for the unfreezing of a Permanent Retirement Account Number (PRAN) under the National Pension System (NPS). By following these steps, you can efficiently fill out the form online.

Follow the steps to complete the Annexure S10 online.

- Click 'Get Form' button to access the Annexure S10 and open it in the editor.

- Select the appropriate Tier option: Tier I, Tier II, or Both. Make sure to mark your choice clearly.

- Fill in your Permanent Retirement Account Number (PRAN) in the designated field.

- Provide your name exactly as it appears on your PRAN card.

- Under Payment Details, enter the amount you wish to unfreeze for Tier I. Ensure you comply with the minimum unfreeze criteria.

- If applicable, fill in the unfreeze contribution amount for Tier II. Again, check that this meets the minimum requirement.

- Calculate and enter the total amount that you want to invest.

- Write the amount in words to confirm your figures.

- Add the date of submission in the specified format (DD/MM/YYYY).

- Sign or add your thumb impression as it appears on your PRAN card.

- Before finalizing, ensure all required fields are filled. Incomplete applications may be rejected.

- After reviewing your form, you may save changes, download, print, or share the form as needed.

Start filling out your Annexure S10 online today.

Related links form

Submitting proof for your NPS contributions involves providing necessary documentation, which may include income proof or identity verification. You can upload your documents through the NPS portal or submit them at designated centers. For guidance on the required paperwork, including the Annexure S10, US Legal Forms can provide helpful templates and resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.