Get Beneficiary Receipt Of Distribution

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

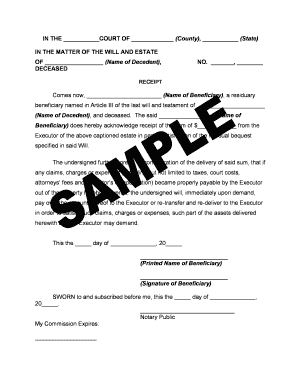

How to fill out the Beneficiary Receipt Of Distribution online

Filling out the Beneficiary Receipt Of Distribution is a critical step for beneficiaries who are receiving their share of an estate. This guide provides clear, step-by-step instructions on how to complete the form accurately and effectively.

Follow the steps to fill out the Beneficiary Receipt Of Distribution.

- Click the ‘Get Form’ button to obtain the document and open it in your preferred editor.

- In the header section, provide the name of the court, county, and state where the estate is being processed. This information is essential for referencing the appropriate jurisdiction.

- Under 'IN THE MATTER OF THE WILL AND ESTATE,' include the name of the decedent as it appears in their official documents.

- Locate the section where you input the case number. This number is typically assigned by the court and can often be found on court documents related to the estate.

- In the 'RECEIPT' section, enter your name as the beneficiary clearly and accurately. Ensure that it matches how it appears in the will.

- Next, indicate the sum you are receiving from the executor. This amount should correspond with the amount outlined in the will or any agreements.

- Review the statement regarding claims, charges, or expenses. Confirm your understanding of this section, which details your obligations should any debts arise related to the estate.

- Complete the date line by filling in the day and month, followed by the year you are signing the document.

- Print your name clearly on the designated line near the bottom of the form, followed by your signature.

- The final step includes the notary section, where a notary public will sign and date the form. Ensure you have a notary available to complete this process.

- Once you have filled out all required fields, you can save your changes, download the form for your records, print it for physical submission, or share it as needed.

Complete your Beneficiary Receipt Of Distribution online today to ensure a smooth processing of your estate distribution.

An inheritance letter for a beneficiary typically outlines the assets being inherited, the names of the beneficiaries, and the terms of the distribution. For instance, the letter may specify that a beneficiary receives a certain percentage of a bank account or a piece of real estate. This document serves as a formal communication to inform beneficiaries of their inheritance and any actions they need to take. Including a Beneficiary Receipt Of Distribution can help clarify the process and confirm receipt of the assets.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.