Loading

Get Form Il 4562

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IL-4562 online

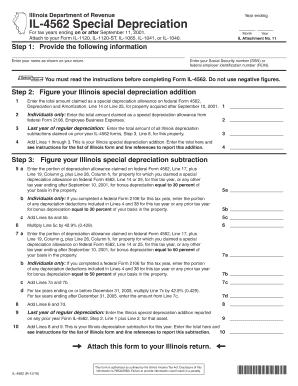

Filing Form IL-4562 is essential for reporting special depreciation for tax purposes in Illinois. This guide provides you with clear, step-by-step instructions to complete the form online, ensuring you have the necessary information and support throughout the process.

Follow the steps to complete your Form IL-4562 online.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Provide your personal information. Enter your name as it appears on your tax return along with your Social Security number (SSN) or federal employer identification number (FEIN). It is important to read the instructions carefully before filling out Form IL-4562, and do not use negative figures.

- Figure your Illinois special depreciation addition. Start by entering the total amount claimed as a special depreciation allowance on federal Form 4562, specifically from Line 14 or Line 25 for property acquired after September 10, 2001.

- If applicable, for individuals only, enter the total amount claimed as a special depreciation allowance from federal Form 2106, Employee Business Expenses.

- To complete the last year of regular depreciation, add all Illinois depreciation subtractions previously claimed on prior year IL-4562 forms.

- Add the amounts from the previous three steps to calculate your Illinois special depreciation addition, and enter the total accordingly.

- Now, figure your Illinois special depreciation subtraction. Begin by entering the portion of the depreciation allowance claimed on federal Form 4562 for property that had a special depreciation allowance for this tax year or any prior tax year.

- If you have completed federal Form 2106, enter any depreciation deductions included for this or prior tax years related to bonus depreciation.

- Multiply the subtotal by 42.9% to arrive at a specific calculation for bonus depreciation.

- Continue to add figures as outlined in the instructions for other relevant lines to accurately complete the Illinois depreciation subtraction for the current year.

- Final step: Review all entered information for accuracy, then save any changes you've made. You can download, print, or share the completed form as required.

Take the next step in managing your tax responsibilities by completing Form IL-4562 online today.

Related links form

You can obtain a depreciation report from your accounting software or tax preparation service. Many platforms, including uslegalforms, offer templates to help you create a comprehensive report. It's important to have accurate records for reporting purposes. If you have questions about the process, customer support can provide assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.