Loading

Get Ct 400 Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

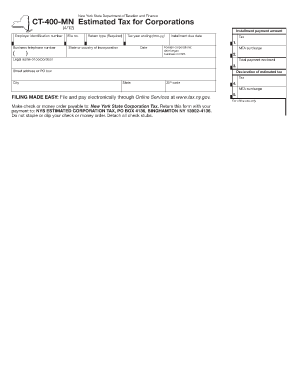

How to fill out the CT-400-MN online

Filing the CT-400-MN form online can be a straightforward process if you follow the correct steps. This guide will provide you with a detailed overview of how to complete each section of the form, ensuring that you provide all necessary information accurately.

Follow the steps to fill out the CT-400-MN form correctly.

- Click the ‘Get Form’ button to access the CT-400-MN form and open it in a suitable editor.

- Enter your employer identification number in the designated field. This number is essential for identifying your corporation with the tax authority.

- Provide the file number associated with your corporation, if applicable. This helps to link your submission with existing records.

- Indicate the installment payment amount that you expect to pay. This amount represents your estimated tax liability for the period.

- Select the return type from the given options. This classification is important for processing your payment correctly.

- Input the tax year ending date in the format mm-yy, which indicates the end of your fiscal period.

- Enter the due date for the installment payment in the provided field. It is crucial to pay on or before this date to avoid penalties.

- Fill in your business telephone number, which may be required for further communication.

- Specify the state or country where your corporation is incorporated to identify the jurisdiction of your business.

- Indicate the date when your foreign corporation began business operations in New York State, if applicable.

- Calculate and enter the MTA surcharge, if relevant, which may apply to corporations operating within the Metropolitan Transportation Authority region.

- Provide the legal name of your corporation, as registered with the state.

- State the total payment you are enclosing with the form, ensuring it matches the estimated tax calculated.

- Complete the street address or PO box for your corporation, including city, state, and ZIP code, to ensure proper mail delivery.

- Review all entered information for accuracy before proceeding to submit the form.

- Finalize the process by saving changes, downloading, printing, or sharing the form as needed.

Complete and file your CT-400-MN form online today for a seamless tax experience.

The challan for regular assessment is a payment form that taxpayers use to remit their income tax due under regular assessment. This form is essential for ensuring that payments are properly recorded and attributed to your tax account. By utilizing UsLegalForms, you can easily access the necessary challan and ensure your payments are made accurately under the Ct 400 Mn.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.