Loading

Get Irs Form 709 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 709 A online

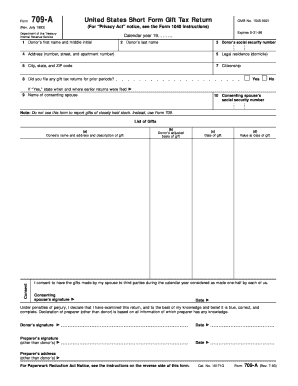

Form 709-A is a short form gift tax return that certain married couples may utilize to report nontaxable gifts they choose to split. This guide provides step-by-step instructions for completing the form online, ensuring all users can accurately navigate its components.

Follow the steps to fill out the Irs Form 709 A online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Complete the donor's information, including their first name, middle initial, last name, social security number, and address including city, state, and ZIP code.

- Provide the donor’s citizenship status and indicate whether any gift tax returns were filed in prior periods, stating the details if applicable.

- List the name of the consenting partner and their social security number, ensuring to check the appropriate consent box.

- In the List of Gifts section, detail each gift made during the calendar year, including the donee’s name and address, a description of the gift, the donor's adjusted basis, the date of the gift, and its value at the date of the gift.

- Ensure the consenting partner signs to declare their consent for gift splitting, including the date of consent.

- Sign the form as the donor, along with entering the date of signature.

- If prepared by someone other than the donor, ensure the preparer signs and provides their address.

- After completing all sections, save any changes, download, print, or share the form as needed.

Complete your Irs Form 709 A online today to ensure compliance with gift tax regulations.

Related links form

Currently, IRS Form 709 cannot be electronically filed. You must print the completed form and mail it to the IRS. If you're looking for guidance on how to fill out this form correctly, consider using US Legal Forms, which can simplify the process of preparing IRS Form 709 A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.