Loading

Get Sa102 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa102 Form online

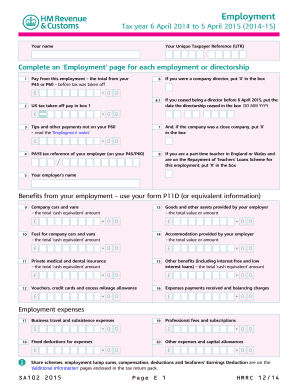

Filling out the Sa102 Form online is an essential task for accurately reporting your employment income. This comprehensive guide provides you with clear and supportive instructions to ensure you complete each section effectively.

Follow the steps to complete the Sa102 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field to identify yourself on the form.

- Provide your Unique Taxpayer Reference (UTR) in the corresponding section.

- For each employment or directorship you held, complete an ‘Employment’ page. Begin with pay from this employment, entering the total from your P45 or P60 before any tax was deducted in the appropriate box.

- Input the UK tax deducted from your pay in box 1 to accurately reflect your tax contributions.

- If applicable, indicate whether the company was a close company by placing an ‘X’ in the respective checkbox.

- If you are a part-time teacher in England or Wales enrolled in the Repayment of Teachers' Loans Scheme, mark ‘X’ in the box provided.

- Include your PAYE tax reference, which can be found on your P45 or P60 forms.

- If you ceased being a director before 6 April 2015, enter the cessation date in the specified format.

- Document any additional tips or payments not included on your P60 in the designated area.

- If applicable, indicate your employer's name in the prescribed section.

- Record the total cash equivalent for benefits received from your employer, such as company cars, other benefits, and private medical insurance, in the respective fields.

- For any employment expenses incurred, including travel and professional fees, note these amounts in the appropriate sections.

- Review all entered information to ensure accuracy before moving to the final steps.

- Once you have completed all sections, save your changes, and consider downloading or printing the form for your records. You can also share the completed document as needed.

Take the next step towards accurate reporting by completing your Sa102 Form online today.

Related links form

To file self-employment income, you need to complete the SA102 form as part of your self-assessment tax return. Gather all relevant financial documents, including income statements and expense receipts. Once you have filled out the form accurately, submit it to HM Revenue and Customs (HMRC) by the deadline. Being organized will make this process smoother.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.