Loading

Get 1120es

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1120es online

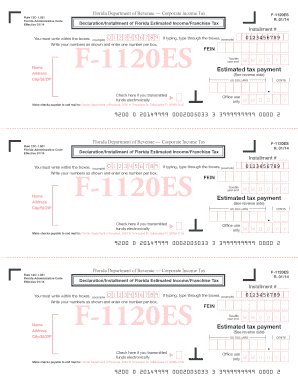

Navigating through tax forms can be challenging, but filling out the 1120es online is straightforward with the right guidance. This document serves as a comprehensive guide to assist you in completing the Florida Estimated Income/Franchise Tax form effectively.

Follow the steps to complete the 1120es online:

- Press the ‘Get Form’ button to acquire the 1120es form and open it in your preferred online editor. Make sure that you have a suitable digital environment for filling out the form.

- Enter your name, address, city, state, and ZIP code in the respective fields. Ensure that you fill in each section clearly and without errors.

- Locate the Installment number box and indicate which installment you are submitting by writing the appropriate number.

- In the FEIN (Federal Employer Identification Number) field, input your employer identification number accurately.

- For the Taxable year end, enter the ending date in the specified format (MM/DD/YYYY).

- In the Estimated tax payment box, input the amount of estimated tax payment for this installment in US dollars.

- If you are transmitting funds electronically, tick the provided checkbox.

- Finally, review all your entries for accuracy, then save your changes. You can choose to download, print, or share the completed form for your records.

Start filling out your documents online to ensure a smooth filing process.

Related links form

Yes, you can request an 1120 tax transcript online through the IRS website. This service allows you to view and print your transcript for your records. For additional support in obtaining your 1120es, US Legal Forms can provide valuable resources and assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.