Loading

Get Employee Hsa Contribution Form 20110526 - Healthequity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee HSA Contribution Form 20110526 - HealthEquity online

Filling out the Employee HSA Contribution Form 20110526 - HealthEquity is a straightforward process aimed at helping you manage your Health Savings Account (HSA) contributions effectively. This guide will walk you through each section of the form to ensure that you complete it accurately and confidently.

Follow the steps to complete the Employee HSA Contribution Form 20110526 online.

- Click ‘Get Form’ button to access the form and open it in the designated editor.

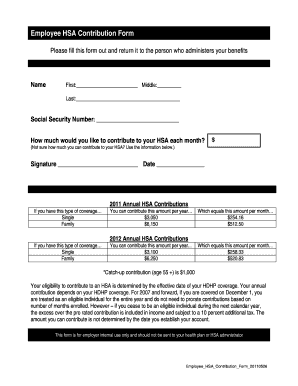

- Begin by entering your name in the designated fields: fill out your first name, middle name (if applicable), and last name.

- Provide your Social Security Number in the specified field to ensure proper identification.

- Decide how much you would like to contribute to your HSA each month and enter that amount in the corresponding field. If unsure, refer to the contribution limits provided in the form you are filling out.

- Sign the form in the provided space to validate your contribution selection.

- Date your signature to indicate when you completed the form.

- Review all the information you have entered to confirm its accuracy before finalizing.

- Depending on your needs, save any changes made, download, print, or share the completed form as required.

Complete your Employee HSA Contribution Form online today to ensure your contributions are accurately recorded.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Process to correct excess contributions Yes: Contributions may need to be removed by your employer by having them complete the 'HSA Employer Contribution Correction Request form. ' If they are unwilling to complete this form, please fill out the 'Distribution of Excess HSA Contribution Form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.