Loading

Get Cp58 Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp58 Sample online

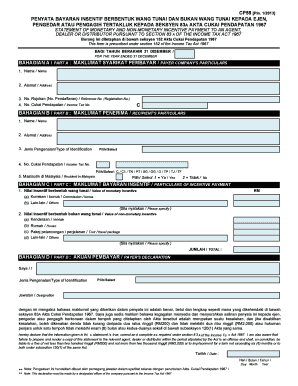

The Cp58 Sample is a crucial document for reporting incentive payments to agents, dealers, or distributors in compliance with the Income Tax Act 1967. This guide provides step-by-step instructions to ensure that every section is accurately completed while filing the form online.

Follow the steps to complete the Cp58 Sample effectively.

- Click ‘Get Form’ button to obtain the form and open it in your chosen online editor.

- In Part A: Payer company's particulars, enter the company's name, address, reference number, and income tax number. Ensure that the information is accurate to maintain compliance.

- In Part B: Recipient's particulars, fill in the recipient’s name, address, type of identification, income tax number, and residency status in Malaysia. Carefully select the appropriate options provided.

- In Part C: Particulars of incentive payment, specify the value of monetary incentives, including any commissions or bonuses, and any non-monetary incentives such as vehicles or travel packages. Clearly detail any other types of incentives.

- In Part D: Payer's declaration, include the type of identification, your designation, and the current date. It is crucial to ensure that this declaration is signed by a designated officer from the company.

- After completing all sections, review the form for any errors. Once verified, save the changes, and you may choose to download, print, or share the form as needed.

Complete the Cp58 Sample online to ensure compliance with the Income Tax Act 1967.

Related links form

A CP58 form is used to report specific tax-related information, especially concerning income that may not be reported on standard tax forms. This helps the IRS track income that could affect your tax liability. Utilizing a Cp58 Sample can guide you in accurately completing the form and ensuring all necessary details are included.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.