Loading

Get Ptc 104 Rebate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PTC 104 Rebate online

The PTC 104 Rebate application is essential for eligible individuals seeking financial relief through property tax and heating expense rebates. This guide provides clear, step-by-step instructions to help users navigate the online filling process effectively.

Follow the steps to complete the PTC 104 Rebate application online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

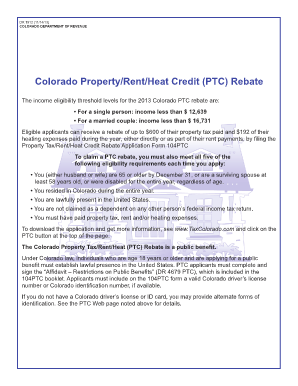

- Review the eligibility criteria thoroughly to ensure you qualify for the rebate, including age, residency, and income requirements.

- Fill in your personal information in the designated fields, including name, address, and valid Colorado driver’s license number or ID number if you have one.

- Indicate your income level and ensure it is below the specified thresholds for single or married applicants.

- Confirm your eligibility by answering all five criteria related to lawful presence, tax status, and residency.

- Detail your property tax paid, rent, and heating expenses in the appropriate sections, attaching any necessary documentation.

- If applicable, complete the 'Affidavit - Restrictions on Public Benefits' (DR 4679 PTC) as part of your application.

- Review your completed form to ensure accuracy and that all required sections are filled out.

- Once all information is confirmed correct, save your changes, then download, print, or share the completed form as needed.

Start your application for the PTC 104 Rebate online today!

A PTC refund refers to the amount returned to homeowners who qualify under the Property Tax Credit (PTC) program. This refund aims to alleviate the financial burden of property taxes. By applying for the PTC 104 Rebate, eligible individuals can receive a refund that helps them manage their living expenses. To ensure a smooth application process, consider utilizing US Legal Forms for necessary documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.