Loading

Get Dr 5714

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 5714 online

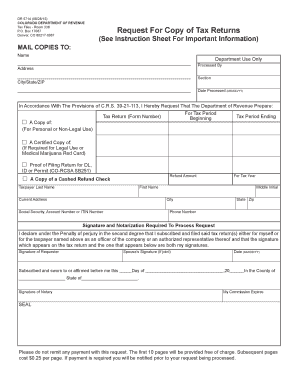

The Dr 5714 is a request form for obtaining copies of tax returns from the Colorado Department of Revenue. This guide provides clear, step-by-step instructions to help you fill out this form accurately and efficiently.

Follow the steps to complete the Dr 5714 online.

- Press the ‘Get Form’ button to access the Dr 5714 document and open it for editing.

- Begin by filling in your first name, middle initial, and last name in the designated fields.

- Provide your current address, including city, state, and ZIP code.

- Next, indicate your social security number, account number, or ITIN number in the specified section.

- Enter your phone number for contact purposes.

- Select the type of copy you are requesting: a copy of the tax return for personal use, a certified copy for legal use, a proof of filing for a driver's license, or a copy of a cashed refund check.

- Fill in the tax period start and end dates and the corresponding tax return form number.

- If applicable, provide the refund amount you received.

- In the signature section, sign the form as the requester. If the request is joint, include your partner’s signature too.

- Date the form in the designated MM/DD/YY format.

- Note that a notary's signature is required; ensure you have it completed with their commission expiration date.

- Review all entered information for accuracy and completeness.

- Finally, save your changes, and choose to download, print, or share the filled-out form as needed.

Complete your Dr 5714 document online to obtain your tax return copies today.

Filling out an Income Tax Return (ITR) step by step starts with collecting your income documents, including salary slips and any investment details. Choose the appropriate ITR form based on your income sources and fill in the required personal information. Ensure you accurately report your income, deductions, and tax liabilities. For clarity, you can refer to US Legal Forms for templates and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.