Loading

Get W2 Form Hawaii

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 Form Hawaii online

The W2 Form Hawaii is an essential document used by employers to report wages paid to employees and the taxes withheld from those wages. Understanding how to accurately fill out this form online is crucial for both employers and employees to ensure compliance with state and federal tax regulations.

Follow the steps to complete the W2 Form Hawaii online

- Click ‘Get Form’ button to obtain the form and open it for editing.

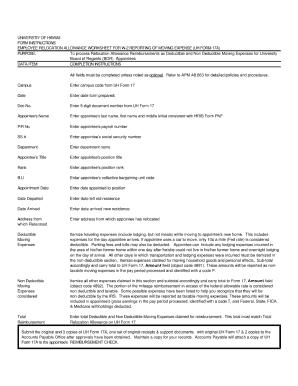

- Begin with section A of the form, where you will need to enter your employer's name, address, and employer identification number (EIN). Ensure that these details are precise, as they are vital for identification.

- In section B, fill out your personal information, including your name, address, and Social Security number. Double-check that your name matches the one on your Social Security card to avoid any issues.

- Proceed to section C to report your wages and tips. This section will require you to enter your total taxable wages, which includes bonuses and other forms of compensation.

- In section D, provide details about the federal income tax withheld. This information will be reported to the IRS, so it's critical to input accurate figures.

- Complete section E, where you'll enter state wages, tips, and other compensation as applicable in Hawaii. This information is necessary for state taxation.

- Next, in section F, fill in the state income tax withheld. Again, accuracy in this figure ensures compliance with state tax laws.

- Review all sections thoroughly for accuracy. If all information is correct, proceed to save all changes made to the form, and then download, print, or share it as required.

Complete your W2 form online today to stay organized and compliant!

If you cannot contact your previous employer, consider checking if your W-2 Form Hawaii is available through online tax services or the IRS. You can also request a wage and income transcript from the IRS, which includes W-2 information. This approach provides you with the data needed for your tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.