Loading

Get Sers W4 P Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sers W4 P Form online

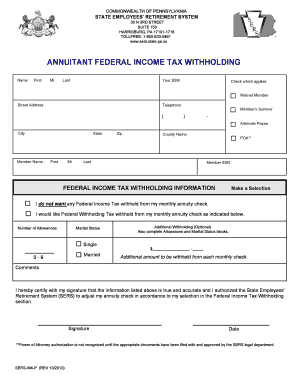

The Sers W4 P Form is essential for retirees in Pennsylvania to manage their federal income tax withholding from monthly annuity checks. This guide will provide clear, step-by-step instructions on how to complete this form online, ensuring that users can easily fill it out correctly.

Follow the steps to complete the Sers W4 P Form accurately

- Click 'Get Form' button to access the form and open it in your online platform.

- Begin by entering your personal information in the 'Name' section. Provide your first name, middle initial, and last name as requested.

- Input your Social Security Number (SSN) in the designated field. This information is necessary for official record-keeping.

- Next, check the box that applies to your status: Retired Member, Member's Survivor, or Alternate Payee.

- Fill in your street address, city, state, zip code, and county name to ensure accurate identification and correspondence.

- In the 'Federal Income Tax Withholding Information' section, choose whether you do not want any federal income tax withheld or how much you would like withheld. If opting for withholding, specify the number of allowances based on your situation.

- Select your marital status by checking either 'Single' or 'Married' and complete additional withholding if desired by indicating an amount.

- Add any comments you feel are necessary in the comments section to provide additional context for your selections.

- Finally, certify the accuracy of the information provided by signing and dating the form.

- Once all fields are accurately filled out, save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Start completing your Sers W4 P Form online today to ensure your federal income tax withholding is set correctly.

Related links form

Individuals who receive pension payments from the SERS need to fill out the SERS W4 P Form. This form is crucial for managing tax withholdings on your pension income. If you want to ensure that the right taxes are withheld, completing this form is necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.