Get Irrevocable Documentary Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irrevocable Documentary Credit Application online

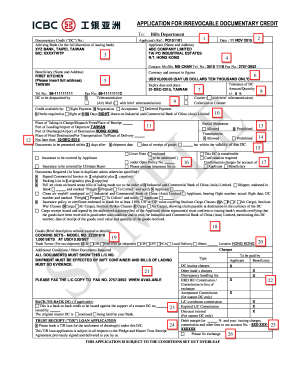

Completing the Irrevocable Documentary Credit Application online can significantly streamline your banking and transaction processes. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to successfully complete your online application.

- Press the ‘Get Form’ button to access the Irrevocable Documentary Credit Application form and open it in your preferred online editing tool.

- Fill in the applicant's reference number in the appropriate section, if applicable. This helps keep track of your application.

- Enter the date of the application clearly, using the format 'DD-MMM-YYYY', for example, '11-NOV-2015'.

- Provide the advising bank's name along with the address and BIC code if you have this information. This is essential for ensuring proper communication with the bank.

- Input the applicant’s name and complete address accurately. This identifies the requester of the documentary credit.

- Fill in the beneficiary's name and address, making sure it's complete and accurate, as this identifies who will receive the payment.

- Specify the currency and amount of the documentary credit. For example, 'USD10,000.00'.

- Set the expiry date and the place where the document will be presented. This is crucial for the validity of the credit.

- Indicate the tolerance of the documentary credit amount and quantity, for example, '+/- 5 %'.

- Select how you want the documentary credit to be dispatched, such as via teletransmission, courier, or collection at counter.

- Choose the credit availability method (sight payment, negotiation, acceptance, or deferred payment) and specify if drafts are required.

- Detail the shipment routing—specifying the port of loading and the destination port.

- Input the latest shipping date and document presentation period to guide compliance.

- Specify whether partial shipments or transshipments are allowed.

- Outline the insurance arrangement, indicating whether it's covered by the applicant, the ultimate buyer, or to be arranged by the bank.

- List all required documents, ensuring that at least duplicates of each document are prepared.

- Describe the goods briefly, including the name, model, quantity, and price.

- Fill in the trade terms accurately to reflect the terms of the sale.

- Add any additional conditions or other required documents, if applicable.

- Indicate which costs will be borne by the applicant and which by the beneficiary.

- Complete any applicable sections regarding back-to-back credits or trust receipt loan applications.

- Provide details for debit accounts if charges are to be drawn from a specific account.

- Review the terms and conditions associated with the application carefully.

- Add the company chop and authorized signatures in compliance with the bank's records.

- Once you have filled in all necessary sections, save your changes. You can then download, print, or share the completed form as required.

Complete your documents online today for a more efficient banking experience.

The purpose of an irrevocable letter of credit is to secure payment for goods or services in international trade. It acts as a safety net, ensuring that sellers receive their payment once they fulfill the conditions outlined in the credit. By using an irrevocable letter of credit, both buyers and sellers can mitigate risks associated with cross-border transactions. You can easily create and manage your Irrevocable Documentary Credit Application through our user-friendly platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.