Loading

Get Filing Status Chart - Jsh Tax And Accounting

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FILING STATUS CHART - JSH Tax And Accounting online

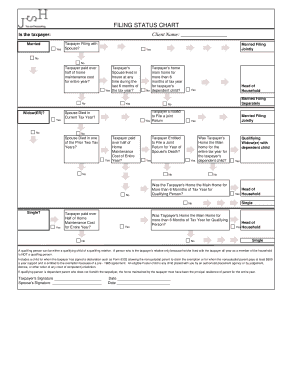

The FILING STATUS CHART - JSH Tax And Accounting is a crucial document for determining the appropriate filing status for your tax return. This guide provides clear instructions on how to complete the chart online, helping you to navigate each section confidently.

Follow the steps to accurately fill out the FILING STATUS CHART

- Press the ‘Get Form’ button to access the FILING STATUS CHART and open it in your preferred editor.

- Start by entering the client name at the top of the form, ensuring it is accurate.

- Indicate whether the taxpayer is married by selecting 'Yes' or 'No' from the options provided.

- Determine if the taxpayer is filing with their spouse by choosing either 'Married Filing Jointly' or 'Married Filing Separately'.

- Assess if the taxpayer paid over half of the home maintenance cost for the entire year and select 'Yes' or 'No'.

- Specify if the taxpayer is a widow or widower by selecting 'Yes' or 'No'.

- Identify if the taxpayer's spouse lived in the house at any time during the last six months of the tax year, selecting the appropriate option.

- Decide if the spouse died in the current tax year and respond accordingly.

- Determine if the taxpayer's home was the main home for more than six months of the tax year for the taxpayer's dependent child.

- If applicable, select 'Head of Household' or other relevant filing statuses based on the responses provided.

- Conclude by checking all responses for accuracy, then save changes, download, print, or share the completed form.

Start completing your FILING STATUS CHART online today.

To find your tax filing status, assess your personal circumstances, such as your marital status and the presence of dependents. You can utilize tools like the FILING STATUS CHART - JSH Tax And Accounting to assist in your determination. Understanding your status is crucial for accurate tax filing and maximizing your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.