Loading

Get Epostcard Form990 Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Epostcard Form990 Org online

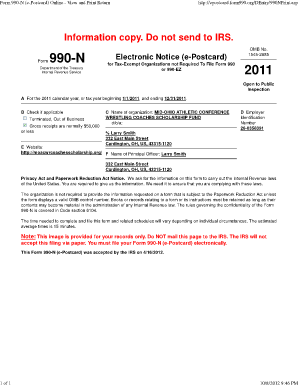

Filling out the Epostcard Form990 Org is essential for tax-exempt organizations with gross receipts of $50,000 or less. This guide provides a structured approach to completing the form accurately and efficiently online.

Follow the steps to complete the Epostcard Form990 Org.

- Click the ‘Get Form’ button to access the Epostcard Form990 Org and open it in your online editor.

- Enter the tax year for which you are filing the form. For example, if you are filing for the 2011 calendar year, specify the start date as 1/1/2011 and the end date as 12/31/2011.

- Indicate if your organization has terminated or is out of business by checking the applicable box.

- Provide the name of your organization in the designated field, such as 'Mid-Ohio Athletic Conference Wrestling Coaches Scholarship Fund'.

- Fill in the Employer Identification Number (EIN) of your organization in the specified field.

- Add the primary contact's name and address details, including street address, city, and ZIP code.

- Include the organization's website if applicable, ensuring it is entered accurately.

- Specify the name of the principal officer and their address, mirroring the information provided for the organization's contact.

- Review all entered information for accuracy and completeness before proceeding.

- Upon confirming the information, you can save your changes, download a copy of the completed form, print it for your records, or share it as needed.

Start filling out your Epostcard Form990 Org online today for prompt compliance.

To file Form 990 electronically, you can use the IRS's e-file system or approved third-party providers. If your organization qualifies for the e-postcard, you can easily submit it through our Epostcard Form990 Org feature. This online tool guides you through the filing process and provides instant confirmation upon submission. Embracing electronic filing helps ensure compliance and keeps your organization in good standing with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.