Loading

Get This Form Is Used To Request A Distribution Of Assets From Traditional Iras, Sep Iras, Simple Iras

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Form Is Used To Request A Distribution Of Assets From Traditional IRAs, SEP IRAs, SIMPLE IRAs online

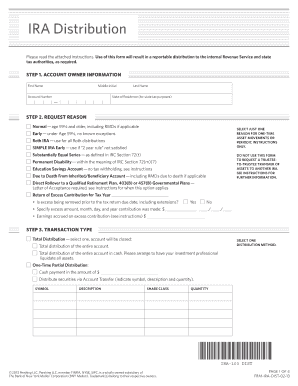

Requesting a distribution of assets from your retirement accounts can seem daunting. This guide provides clear instructions on how to complete the form used for such requests, ensuring a smooth and efficient process.

Follow the steps to successfully complete your request for a distribution of assets.

- Click ‘Get Form’ button to access the form and open it for completion.

- In Step 1, provide your complete name (first, middle initial, last), account number, and state of residence using the two-letter state abbreviation.

- For Step 2, select the reason for your request. Options include normal distributions, permanent disability, or education savings account distributions, among others. Ensure you consult a tax professional regarding any potential taxes or penalties.

- In Step 3, choose the transaction type. Options include total distribution of the entire account, a one-time partial distribution specifying the amount, or setting up a periodic distribution with required details.

- Step 4 involves selecting tax withholding elections. You can choose whether or not to withhold federal income tax, as well as state income tax, based on your personal preference and tax situation.

- In Step 5, select your preferred method of delivery for your distribution, such as by check, ACH transfer, or wire transfer. Ensure you provide accurate details for alternate payees if necessary.

- Optional Step 6 allows you to set up standing instructions for future payments so you do not need to fill the form repeatedly for similar requests.

- If fees are applicable, state them in Step 7, specifying whether to deduct them from your IRA or non-retirement account.

- Finally, in Step 8, sign and date the form to validate your request. Remember that your signature is crucial for processing.

Complete your documents online today for a seamless experience.

Related links form

Yes, you must report any distributions from your traditional IRA on your tax return. This includes any amounts you withdrew during the tax year, as they are considered taxable income. Failing to report these distributions may lead to penalties, so it is important to keep accurate records. Remember, this form is used to request a distribution of assets from traditional IRAs, SEP IRAs, SIMPLE IRAs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.