Loading

Get Canada T3010 E 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T3010 E online

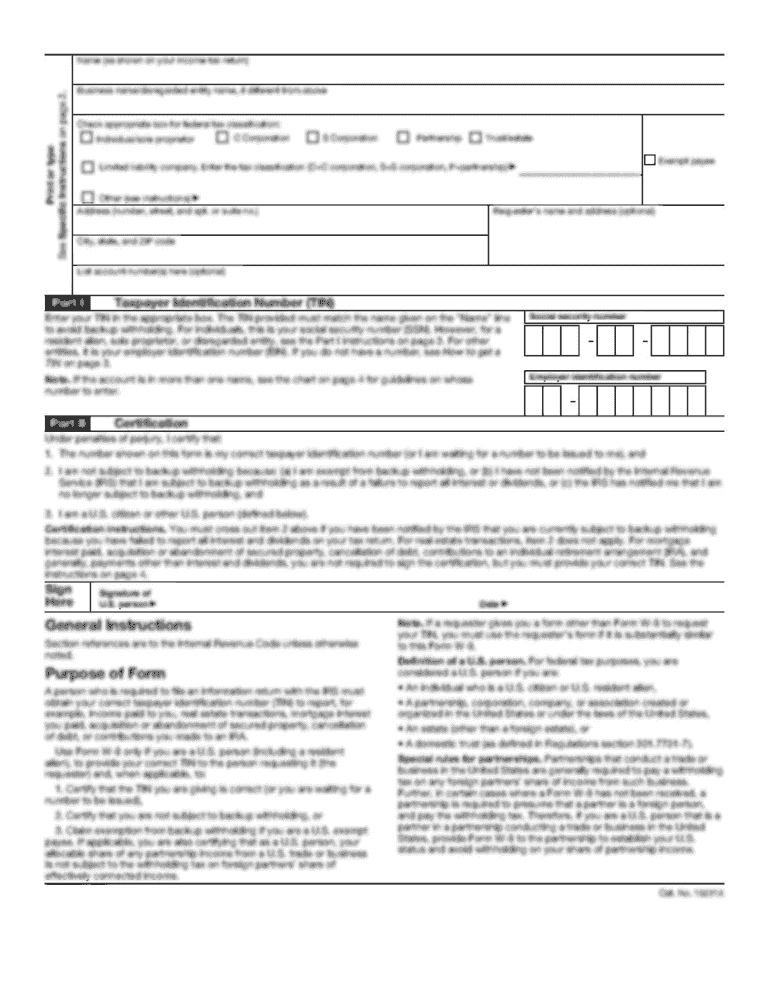

Completing the Canada T3010 E form is essential for registered charities in Canada to report their financial activities and maintain their status. This comprehensive guide provides clear, step-by-step instructions to ensure you fill out the form accurately and efficiently online.

Follow the steps to complete your form correctly.

- Press the ‘Get Form’ button to obtain the T3010 E form and open it in your editor of choice.

- Begin with Section A, Identification. Fill in the charity name, return for the fiscal period ending (year and month), and the BN/registration number. Also, include the web address, if applicable.

- Complete question A1 regarding the charity's position to a head body, if applicable. If yes, provide the name and BN/registration number of the head organization.

- For question A2, indicate whether the charity has wound up, dissolved, or terminated operations.

- In question A3, specify if the charity is classified as a public or private foundation. If applicable, include any required Schedule 1 forms.

- Proceed to Section B, where you must complete Form T1235, which documents the Directors/Trustees and Like Officials.

- In Section C, provide information about the charity’s programs. Answer if the charity was active during the fiscal period in question C1. Fill in ongoing and new programs in C2.

- Question C3 regards whether the charity made gifts or transferred funds to qualified donees. Complete Form T1236 if applicable.

- Complete additional questions in Section C regarding fundraising activities, compensation of directors, and donor information as prompted.

- In Section D, provide financial information. Ensure to show all amounts to the nearest single Canadian dollar, include total assets, total liabilities, total revenue, and expenditures.

- Sign and date the certification in Section E by an individual authorized on behalf of the charity.

- Fill out Section F with the physical address and contact details of the charity's books and records.

- Review the checklist to ensure all components, including any applicable schedules, are completed.

- Finally, save your changes, download the completed form, and prepare to submit it according to your charity’s requirements.

Start filling out your Canada T3010 E form online today to maintain your charity's registered status.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain charity status in Canada, you must apply through the Canada Revenue Agency and meet specific eligibility criteria. The application process involves submitting various documents, including a completed Canada T3010 E form. Utilizing resources like uslegalforms can guide you through each step of this process, ensuring you provide all necessary information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.