Get Il Cli006f 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CLI006F online

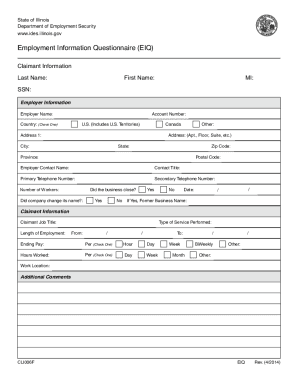

Filling out the IL CLI006F form is an essential step in submitting your employment information questionnaire accurately. This guide provides users with clear, step-by-step instructions for completing the form online, ensuring that you understand each section and field easily.

Follow the steps to complete the IL CLI006F effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your last name, first name, and middle initial in the claimant information section. Ensure your name is spelled correctly as it appears on official documents.

- Enter your Social Security Number (SSN) in the designated field to identify your claim.

- In the employer information section, provide the employer's name and account number. This information is crucial for linking your claim to the appropriate employer.

- Select the country by checking the appropriate box. Options include U.S. (which includes U.S. territories) or Canada.

- Fill in the employer's address, including address line one, apartment or suite (if applicable), city, state, and zip code, or the province and postal code if the employer is in Canada.

- Provide the employer contact name and their title for any necessary follow-ups regarding your claim.

- Input both the primary and secondary telephone numbers of the employer for future correspondence.

- Indicate the total number of workers employed by the business.

- Answer whether the business has closed or changed its name by selecting 'Yes' or 'No.' If applicable, provide the former business name and the date of the change.

- In the claimant information section again, provide the type of service performed and your job title.

- Detail your length of employment by entering the start and end dates.

- Indicate your ending pay and select the time period (e.g., per hour, day, week, etc.).

- Fill out the hours worked section, specifying how often you worked (e.g., daily, weekly).

- Provide the work location and any additional comments that may be relevant to your claim.

- Review all entered information for accuracy. Once verified, you can save changes, download, print, or share the completed form as needed.

Complete your documentation online now to ensure prompt processing of your claim.

Filing Illinois state taxes without a state ID is possible, though it requires additional steps. You can complete the IL CLI006F form by providing alternative identification, such as your Social Security number. Make sure to include all required financial information to ensure your tax return is processed smoothly. Utilizing uslegalforms can help streamline this process, offering resources tailored to your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.