Loading

Get Uk Hmrc Tc846 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC TC846 online

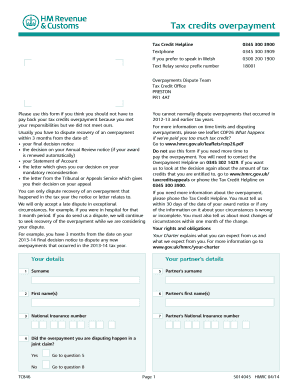

This guide provides step-by-step instructions for filling out the UK HMRC TC846 form online. Designed for users with varying levels of experience, this resource will help you navigate the process with clarity and confidence.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your details in the designated fields at the top of the form. This includes your surname, first name(s), and National Insurance number. Ensure this information is accurate to avoid delays.

- If applicable, enter your partner's details, including their surname, first name(s), and National Insurance number if the overpayment relates to a joint claim.

- Specify the tax year or period during which the overpayment occurred. You can find this information on your award or renewal notices.

- Respond to the questions regarding your communication with HMRC about the overpayment. Answer 'Yes' or 'No' to each question and provide details if you have ticked 'Yes'.

- If you disagree with the overpayment for reasons stated in the previous questions, detail these reasons and any exceptional circumstances that were present at the time.

- Enter your address and contact numbers to facilitate easy communication regarding your dispute. Include a preferred time for HMRC to call you.

- Finally, sign and date the form in the designated area. This completes your submission and formalizes the dispute.

- Once you have filled out the form, make sure to save your changes. You can then download, print, or share the completed form as needed.

Start completing your UK HMRC TC846 form online today for a smooth submission process.

If you have received a tax credit overpayment, you will need to repay the excess amount to UK HMRC TC846. Start by contacting HMRC to confirm the amount owed and the payment methods available. You can choose to repay the amount in full or arrange a repayment plan if necessary. For easy management of this process, consider using the resources from US Legal Forms to help you handle all required documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.