Loading

Get Gsa Sf 714 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GSA SF 714 online

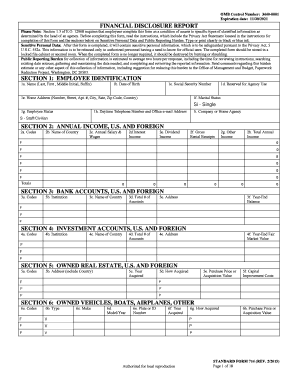

The GSA SF 714 is a Financial Disclosure Report required for employees seeking access to specific classified information. This guide aims to provide comprehensive and user-friendly instructions on completing the form online, ensuring that users can navigate each section with clarity and confidence.

Follow the steps to complete the GSA SF 714 successfully

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Section 1, Employee Identification. Enter your full name, date of birth (MM/DD/YYYY), social security number (###-##-####), and your home address, including city, state, and zip code. Indicate your marital status and employee status using the provided codes.

- Move to Section 2, Annual Income, U.S. and Foreign. Enter relevant income data for yourself, your spouse, and dependent children. Ensure to report salaries and wages under the appropriate columns, and remember to use zero for amounts below the specified thresholds.

- In Section 3, Bank Accounts, U.S. and Foreign, provide details about your bank accounts, including the financial institution’s name, address, and total number of accounts. Report the year-end balance for each account.

- Proceed to Section 4, Investment Accounts, where you will list your investment accounts, including the types and values as of December 31 of the preceding year.

- Complete Section 5, Owned Real Estate, by listing any properties owned, including details on how they were acquired and their purchase price or acquisition value.

- For Section 6, Owned Vehicles, Boats, Airplanes, list any vehicles owned. Provide necessary details including type, make, model/year, and how they were acquired.

- In Section 7, Real Estate You Lease or Rent, indicate any properties leased, ensuring to include the monthly payment and dates associated with the lease.

- For leased vehicles or other types in Section 8, report similar details as provided in the previous sections.

- In Section 9, Other Assets, you will list any assets valued at $5,000 or more that do not fit in previous categories.

- Section 10 covers Mortgages, Loans, and Other Liabilities. List all relevant financial liabilities, ensuring to include the creditor's information.

- Continue to Section 11 for Credit Cards, where you will report any outstanding balances above the specified limit.

- Section 12 is for Additional Income or Bankruptcy, providing details of significant gifts, inheritances, or any bankruptcies filed.

- Complete Section 13 by listing safe deposit boxes held at financial institutions.

- Use Section 14 for any comments that clarify prior entries on the form.

- Finally, in Section 15, provide certification by typing your name, signing the form, and entering the date signed.

- After completing the form, you can save changes, download, print, or share the form as necessary.

Start filling out the GSA SF 714 online today to ensure your secure access to classified information.

Whether you need to complete a financial disclosure depends on your role within the government. If you hold a position that could lead to conflicts of interest, you likely must file. The GSA SF 714 outlines these requirements clearly. USLegalForms can guide you through the process to ensure you meet all necessary criteria.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.