Loading

Get Gsa Sf 329c 1998-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GSA SF 329C online

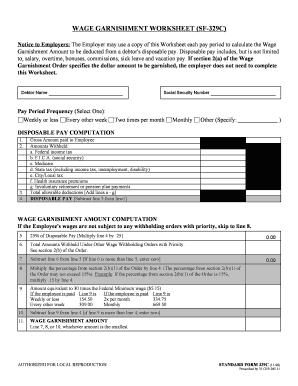

The GSA SF 329C is a crucial document used by employers to calculate the wage garnishment amount deducted from a debtor's disposable pay. This guide provides a step-by-step approach for completing the form online, ensuring clarity and accuracy throughout the process.

Follow the steps to successfully complete the GSA SF 329C

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the debtor's name in the designated field at the beginning of the form.

- Select the pay period frequency by marking the appropriate option: Weekly or less, Every other week, Two times per month, Monthly, or Other (specify).

- Input the debtor's social security number in the specified section.

- In the Disposable Pay Computation section, complete the following: Enter the Gross Amount paid to the employee in line 1.

- List all amounts withheld in the lines a through g, including federal income tax, F.I.C.A., Medicare, state tax, city/local tax, health insurance premiums, and involuntary retirement or pension plan payments.

- Calculate the total allowable deductions by adding the values from lines a through g and record it in line 3.

- Determine the disposable pay by subtracting line 3 from line 1 and record this value in line 4.

- For the Wage Garnishment Amount Computation, if wages are not subject to withholding orders with priority, skip to line 8. Otherwise, in line 5, calculate 25% of disposable pay by multiplying the value in line 4 by 0.25.

- Record any total amounts withheld under other wage withholding orders with priority in line 6.

- Subtract line 6 from line 5 and place the result in line 7. If line 6 exceeds line 5, enter zero.

- In line 8, multiply the percentage from section 2(b)(1) of the Order by line 4. Ensure this percentage does not exceed 15%.

- Review line 9, which signifies the amount equivalent to 30 times the Federal Minimum wage based on the employee's pay frequency.

- Subtract line 9 from line 4, recording the result in line 10. If line 9 exceeds line 4, enter zero.

- The final wage garnishment amount will be the smallest value from lines 7, 8, or 10, which you will enter in line 11.

- Once all fields are completed, review the form for accuracy. Users can then save changes, download, print, or share the form as needed.

Complete and submit your GSA SF 329C online today for accurate wage garnishment calculations.

The wage garnishment process generally begins with a court order, which notifies your employer to withhold a portion of your wages. After receiving this order, your employer must comply and send the deducted amount to the creditor. Understanding the GSA SF 329C is crucial, as it outlines the rights and responsibilities of all parties involved in the garnishment process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.