Loading

Get Asset Acquisition Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Asset Acquisition Form online

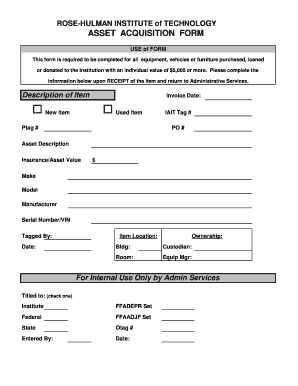

The Asset Acquisition Form is essential for documenting the purchase, loan, or donation of equipment, vehicles, or furniture valued at $5,000 or more. This guide provides step-by-step instructions for completing the form efficiently and accurately.

Follow the steps to fill out the Asset Acquisition Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering the description of the item being acquired in the designated field. Be specific to ensure clarity regarding the asset.

- Next, provide the invoice date in the specified format. This date is crucial for tracking and record-keeping.

- Indicate whether the item is new or used by selecting the appropriate option.

- Fill in the Ptag number, IAIT tag number, purchase order number (PO #), and any other identification numbers applicable to the asset.

- Detail the asset description, including its insurance or asset value, which should be expressed in dollar amounts.

- Provide the make, model, manufacturer, and serial number or VIN of the item. Accurate details here are essential for identification and future reference.

- Enter the location of the item, detailing the building and room number, and the person responsible for custodianship.

- For internal use by Administrative Services, select the ownership status by checking the relevant box — whether titled to the Institute, federal, or state.

- Finally, confirm who entered the information and the date on which the form was completed.

- After completing all fields, save your changes. You can then download, print, or share the form as necessary.

Complete your Asset Acquisition Form online today to ensure proper documentation and management.

Related links form

To fill an asset declaration form, start by gathering all necessary information about your assets. This includes details such as the type of asset, its value, and any relevant documentation. You can easily find an asset acquisition form template on US Legal Forms, which provides guidance throughout the process, ensuring you complete the form accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.