Loading

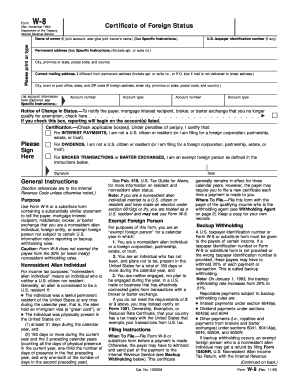

Get Form W8 November 1992

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W8 November 1992 online

Filling out the Form W8 is essential for individuals and foreign entities who need to declare their nonresident status for U.S. income tax purposes. This guide provides clear, step-by-step instructions to help you complete the form accurately online.

Follow the steps to successfully complete the Form W8.

- Click the ‘Get Form’ button to access the Form W8 and open it in your chosen editing platform.

- Enter your name in the designated field. If the account is joint, include the joint owner’s name as well.

- Provide your U.S. taxpayer identification number, if you possess one, in the appropriate field.

- Fill in your permanent address, including street number, apartment or suite number, city, province or state, postal code, and country.

- If your current mailing address differs from your permanent address, input your mailing address in the specified section.

- Complete the account information section if applicable, listing any account numbers and types that apply. This is optional.

- Indicate if you wish to notify the payer of a change in status by checking the appropriate box. Understand that this initiates reporting on the account(s) listed.

- Certify the information provided by checking the applicable boxes related to your status as a U.S. citizen, resident, or exempt foreign person before signing.

- Sign and date the form where indicated, ensuring that the signature corresponds to the individual or entity listed.

- After completing all sections, save your changes, then download, print, or share the completed form as necessary.

Complete your Form W8 online today to ensure proper compliance with U.S. tax regulations.

Submitting a W8 form typically involves providing it to the U.S. entity that is paying you income. You can also utilize online services like uslegalforms for a more efficient process. Remember to check that the Form W8 November 1992 is accurately filled out to ensure timely processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.