Loading

Get Form W 4 University Of Wisconsin

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W 4 University Of Wisconsin online

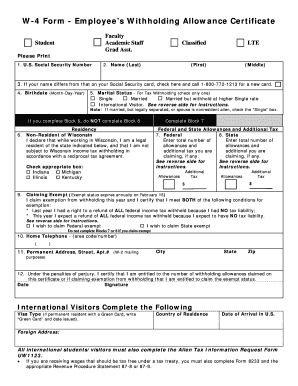

Filling out the Form W 4 University Of Wisconsin is an essential step for employees to ensure accurate withholding of taxes from their paychecks. This guide will walk you through the process of completing the form online, section by section, making it accessible and straightforward for everyone.

Follow the steps to fill out the Form W 4 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your U.S. Social Security number by entering it in the designated field.

- Enter your full name, including your last name, first name, and middle initial in the appropriate fields.

- If your name differs from the one on your Social Security card, check the box and contact the relevant authority for a new card.

- Fill in your birthdate using the format Month-Day-Year.

- Select your marital status for tax withholding by checking one of the provided options.

- If you are a non-resident of Wisconsin, declare your residency by selecting the appropriate state from the provided list.

- Enter the total number of federal allowances you are claiming in Block 7 and additional tax, if applicable.

- Do the same for state allowances in Block 8.

- If eligible, indicate your claim for exemption from withholding in Block 9.

- Provide your home telephone number, including the area code.

- Complete your permanent address using the provided fields.

- Sign and date the form, certifying that you are entitled to the withholding allowances claimed.

- For international visitors, complete the additional required fields.

- Once all details are filled in, you can save changes, download, print, or share the completed form as necessary.

Complete your Form W 4 online now to ensure accurate tax withholding!

Related links form

You should submit your W-4 form to your employer or their payroll department. It is important to keep a copy for your records. If you are using the Form W 4 University Of Wisconsin, ensure that it is submitted promptly to avoid any delays in your tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.