Loading

Get 12b 5806 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 12b 5806 Form online

Completing the 12b 5806 Form can be straightforward when you have a clear understanding of each section. This guide will walk you through the process of filling out the form online, ensuring you provide all necessary information confidently.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to obtain the 12b 5806 Form and open it in your browser or online editor.

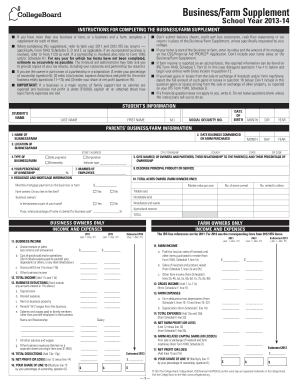

- Begin by filling out the student's information. Enter the student's name, date of birth, and social security number accurately.

- Next, provide the parents' business or farm information. Include the name of the business or farm, the commencement date, location, type of business, and total acres owned if applicable.

- Indicate the ownership percentage and number of employees for the business or farm. This section is crucial for understanding the parent's involvement in the operation.

- Fill in the financial details for the business or farm. Report gross income, business deductions, and net profit or loss for the years specified: 2011, 2012, and estimated 2013.

- For farms, complete the section for income and expenses, indicating any applicable sales, profits, or losses related to livestock or produce.

- Report the assets of the business or farm. Provide the fair market value and any associated debts, ensuring to include current and fixed assets.

- At this point, review your entries for accuracy. Make sure all fields are filled according to the instructions provided, especially if a question does not apply to you, enter '0' instead of leaving it blank.

- Once completed, you can save changes. You may choose to download, print, or share the form as necessary.

Start filling out your documents online today for a smoother submission process.

Line 12B on the 1040 ES form pertains to the estimated tax for the current year, specifically for individuals who may owe additional taxes. This line requires you to input your expected tax liability, which can be calculated using the information from your 12B 5806 Form. Understanding how to accurately report this can help you avoid underpayment penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.