Loading

Get Mass W9 Form April 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mass W9 Form April 2009 online

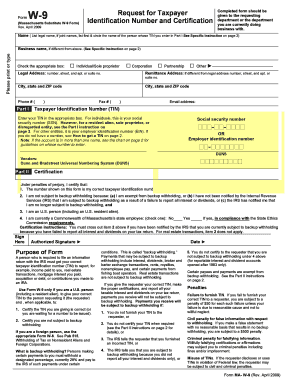

Filling out the Mass W9 Form April 2009 online is an essential process for individuals and businesses to provide their taxpayer identification information. This guide will walk you through each section of the form to ensure you complete it accurately and effectively.

Follow the steps to fill out the Mass W9 Form online

- Press the ‘Get Form’ button to access the form and open it in your preferred editing platform.

- Enter your legal name in the designated field. If you are filing jointly, list the first name and circle the name of the person whose taxpayer identification number you will provide in Part I.

- If your business name is different from your legal name, please indicate it in the business name field.

- Select the appropriate box to categorize your tax status: Individual/Sole Proprietor, Corporation, Partnership, or Other.

- Fill out your legal address, including the street number, apartment or suite number, city, state, and ZIP code.

- If your remittance address differs from the legal address, provide that information in the remittance address field.

- Provide your phone number in the designated area for contact purposes.

- In Part I, enter your taxpayer identification number (TIN). For individuals, this is your Social Security number. If you are a resident alien or a sole proprietor, refer to the instructions for accurate entry.

- For organizations, enter your Employer Identification Number (EIN). If you do not have a TIN, follow the instructions for obtaining one.

- In Part II, review and certify the accuracy of your taxpayer identification number by signing the form.

- Finally, date your form and ensure all required fields are completed before saving your changes or downloading the completed form.

Complete your documents online to ensure a smooth filing process.

Related links form

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.