Get Attachment E State Grant Certification No Overdue Tax Debts Instructions: Grantee Should Complete

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Attachment E State Grant Certification No Overdue Tax Debts Instructions: Grantee Should Complete online

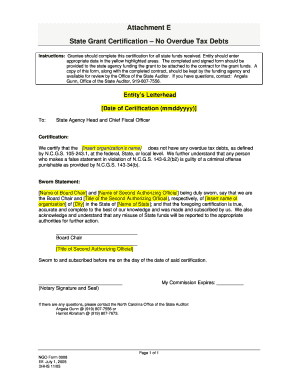

This guide provides clear instructions for completing the Attachment E State Grant Certification, ensuring that grantees can fill out the form accurately and effectively. Follow these steps to certify that your organization has no overdue tax debts and successfully submit the required documentation.

Follow the steps to complete your certification form.

- Click the ‘Get Form’ button to access the certification form. This will open the document for you to begin filling it out.

- Locate the entity’s letterhead section. Enter your organization’s name and the date of certification in the appropriate format (mmddyyyy). Ensure that this information is accurate as it appears at the top of the document.

- In the certification section, confirm that your organization does not have any overdue tax debts. Replace the placeholder text '[insert organization’s name]' with the correct name of your entity.

- Identify the names of the individuals responsible for the certification. Input the name of the Board Chair and the title of the second authorizing official in the respective fields, ensuring clarity and correctness.

- Provide the location details in the sworn statement by inserting the city and state where your organization is based. Confirm that all details are true and complete.

- Ensure that the signature of the Board Chair and the second authorizing official is included in the designated areas. Both must be aware of the responsibilities they are taking by signing this certification.

- Complete the notarization section by having the notary public sign and seal the document. This step is crucial for the legal validity of the certification.

- Review the entire form to ensure accuracy. Once reviewed, save changes to the document, and consider downloading it for your records.

- Print the completed form for submission or share it with the relevant state agency as required. Ensure you keep a copy for your organization’s files.

Complete your Attachment E State Grant Certification online today to ensure timely submission and compliance.

As of now, the IRS has not confirmed plans to send out $3000 tax refunds in June 2025. Any potential changes related to tax refunds typically depend on legislation or policy adjustments. For updates related to your tax obligations and potential refunds, stay informed by reviewing the Attachment E State Grant Certification No Overdue Tax Debts Instructions: Grantee Should Complete regularly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.