Get Certified Payroll Checklist Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certified Payroll Checklist Form online

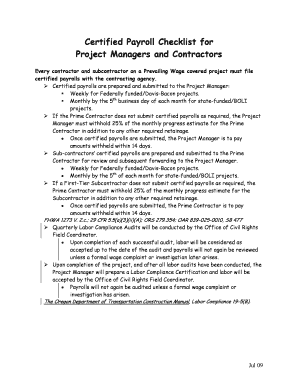

The Certified Payroll Checklist Form is essential for contractors and subcontractors on prevailing wage projects to ensure compliance with labor laws. This guide provides clear and supportive instructions on how to accurately complete this form online.

Follow the steps to fill out the Certified Payroll Checklist Form online.

- Click ‘Get Form’ button to access the Certified Payroll Checklist Form and open it in your preferred editor.

- Begin by entering the name, address, and Social Security number of each employee. Ensure to use the full name and address on the first payroll period and any updates thereafter.

- Provide the trade classification and applicable group number for each employee. If you have apprentices, specify their classification and percentage level.

- Record the day of the week and the corresponding date for each payroll submitted.

- Document the number of straight time hours worked by each employee on the project for each day.

- Indicate the number of overtime hours worked by each employee on the project each day.

- Calculate the total straight time hours worked during the week for all employees involved in the project.

- Calculate the total overtime hours worked during the week for all employees on the project.

- Provide the base hourly rate of pay for each employee, ensuring it meets the minimum requirements stipulated in the applicable wage determination.

- Calculate and report the overtime hourly rate based on the base rate and any required fringe benefits.

- List the hourly fringe benefit amount paid to employees, reporting it separately for state-funded projects.

- Record the gross amount earned by each employee during the week, including total wages earned on other projects if applicable.

- Document deductions such as FICA and federal/state taxes, ensuring that any unique deductions are explained on the first payroll.

- Calculate the net wages for each employee by subtracting deductions from the gross earnings.

- If applicable, specify the hourly amount of fringe benefits paid to any benefit plans.

- Ensure a certification page is attached to every payroll, signed as required, and confirming it correlates to the proper funding source.

- After completing the form, save your changes, and prepare to download, print, or share the Certified Payroll Checklist Form as necessary.

Complete your Certified Payroll Checklist Form online to ensure compliance and streamline your documentation process.

Yes, form WH-347 is typically required for employers working on federally funded construction projects. This form must be submitted to verify that workers receive the correct wages as mandated by law. Using the Certified Payroll Checklist Form can help you gather the necessary information to complete WH-347 accurately. Ensuring you have this form ready will aid in your compliance efforts and avoid potential fines.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.