Get 120-18 Application For Refund3. 120-18 Application For Refund3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 120-18 Application For Refund3 online

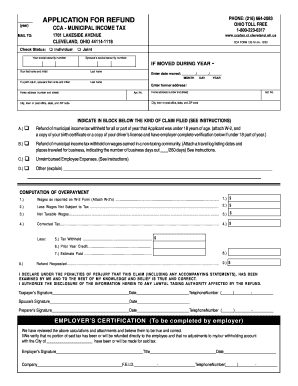

This guide provides a detailed overview of how to fill out the 120-18 Application For Refund3. By following these step-by-step instructions, users will be able to successfully complete and submit the application online, ensuring that their refund request is accurate and complete.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the year for which you are claiming the refund in the upper left-hand corner of the form.

- Provide your social security number in the space provided. If filing jointly, include your spouse’s social security number.

- Fill in your full name and address. If you relocated during the year, indicate the date of the move and list your former address.

- Mark the box representing the type of refund claim you are filing. Choose from options A, B, C, or D as applicable, and provide any necessary documentation.

- For the computation of the overpayment, enter the local wages reported on your W-2 form in Line 1. Ensure each W-2 or related document is attached.

- Subtract any wages not subject to tax, entering that total in Line 2 and calculating your net taxable wages for Line 3.

- Calculate the corrected tax based on your net taxable wages and applicable tax rate. Enter the result in Line 4.

- Complete Lines 5 through 8 with the relevant amounts, ensuring all required calculations are performed correctly.

- Calculate the refund amount by subtracting the total credits from the corrected tax, as indicated in Line 9.

- Sign and date the form; ensure that both parties sign if filing jointly. If filing on behalf of another, include a Power of Attorney form.

- If your employer's certification is needed, ensure it is filled out and signed by the appropriate representative.

- Review the completed form for accuracy before submission. You can then save changes, download, print, or share the form as needed.

Complete your 120-18 Application For Refund3 online today for a seamless refund process.

To make a refund application, you need to gather relevant documents and complete the 120-18 Application For Refund3. Start by verifying your eligibility and collecting all necessary information, such as past tax returns. Using platforms like uslegalforms can simplify this process, providing step-by-step guidance and templates to ensure you submit everything correctly. Once you've prepared your application, submit it as instructed and await your refund.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.