Loading

Get Instructions For Gr-1065-2005.doc. Short Form Return Of Organization Exempt From Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INSTRUCTIONS FOR GR-1065-2005.doc. Short Form Return Of Organization Exempt From Income Tax online

Filling out the INSTRUCTIONS FOR GR-1065-2005 doc can be a straightforward process with the right guidance. This guide provides a detailed, user-friendly approach to ensure you correctly complete the form online.

Follow the steps to successfully fill out your tax return.

- Click the ‘Get Form’ button to download the form and open it in your preferred online editor.

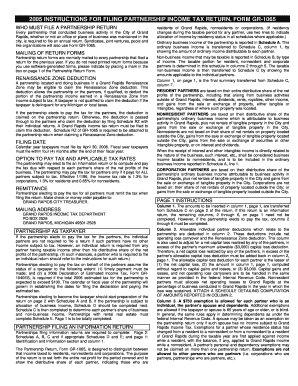

- Begin by completing the identification and information section at the top of the form, including the name of the partnership, federal employer identification number, address, and type of return.

- Indicate whether the return is an initial or final Grand Rapids return, and provide the date business started and the number of employees on December 31, 2005.

- List the names and addresses of each partner, along with their social security or federal identification numbers, indicating whether they are full-year residents, part-year residents, or nonresidents.

- Complete the tax payment section, specifying whether the partnership will pay tax on behalf of all partners. If filing an information return, complete only the necessary sections.

- Fill out the columns for total income, allowable individual deductions, exemptions, and tax calculations based on partner residency.

- Complete Schedules A, B, C, and, if applicable, D and E, detailing the partnership's ordinary business income and non-business income.

- Verify all totals from Schedules A and B are accurate in Schedule C, ensuring they reflect the distribution of income to partners.

- Review and fill in any relevant payments, credits, and declare any overpayment or balance due.

- Finalize the form by signing and dating it, then save, download, or print the completed document for submission.

Start completing your INSTRUCTIONS FOR GR-1065-2005.doc online today for a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing exempt on your tax form involves indicating your organization’s tax-exempt status when completing the forms. You will need to provide details as outlined in the INSTRUCTIONS FOR GR-1065-2005.doc, Short Form Return Of Organization Exempt From Income Tax, to ensure accurate processing. This ensures that your organization adheres to tax regulations while benefiting from the exempt status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.