Get Form 966

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 966 online

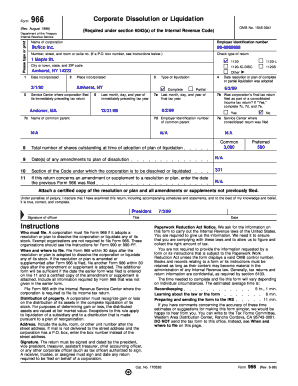

Form 966 is a critical document used by corporations planning to dissolve or liquidate their assets. This guide provides clear and detailed instructions for users on how to effectively complete this form online, ensuring compliance with Internal Revenue Service requirements.

Follow the steps to fill out Form 966 online

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the name of the corporation as it appears in your records, followed by the employer identification number.

- Fill in the address by providing the number, street, and room or suite number (if applicable). Use this section to clarify any P.O. box numbers as instructed.

- In the section for the type of return, check the appropriate box based on your entity's structure.

- Complete the city, state, and ZIP code fields based on the location of the corporation.

- Indicate the date the corporation was incorporated and the place of incorporation.

- Provide the service center where the corporation filed its immediately preceding tax return.

- Specify the type of liquidation by checking either 'Complete' or 'Partial'.

- Fill out the last month, day, and year of the corporation's final tax year.

- Complete the fields regarding the name and employer identification number of the common parent if applicable.

- List the total number of shares outstanding at the time the plan of liquidation was adopted.

- If there were any amendments to the plan, please document the dates of those amendments.

- Select the section of the tax code under which the corporation is being dissolved or liquidated.

- If this form serves as an amendment or supplement, enter the date of any previous Form 966 filed.

- Attach a certified copy of the resolution or plan along with all amendments that were previously filed.

- Sign and date the form in the specified officer section, ensuring that the appropriate officer of the corporation completes this task.

- Once completed, save changes and proceed to download, print, or share the form as necessary.

Start filling out your Form 966 online to ensure you meet all filing requirements.

Yes, you can file Form 966 online through the IRS website or other authorized platforms. Filing electronically can streamline the process and reduce errors, making it a convenient option for many corporations. Additionally, consider using the US Legal Forms platform for easy access to necessary forms and guidance on submitting them correctly. Embracing online filing can save you time and effort.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.