Get Oregongov Statment Of Financial Condition For Individuals Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregongov Statement Of Financial Condition For Individuals Form online

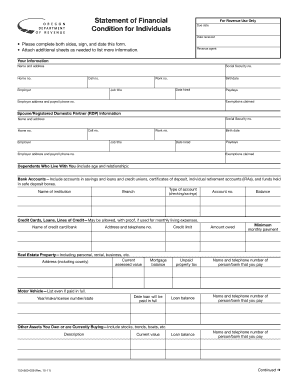

Filling out the Oregongov Statement Of Financial Condition For Individuals Form is an essential step for individuals looking to provide their financial information to the Oregon Department of Revenue. This guide will walk you through each section of the form to ensure that you complete it accurately and efficiently, even if you have little legal experience.

Follow the steps to successfully complete your financial condition statement.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out your information: Provide your full name, address, and Social Security number. Include contact numbers for home, cell, and work. Specify your date of hire, job title, employer, birthdate, paydays, and exemptions claimed.

- Provide information about your spouse or registered domestic partner. Enter their Social Security number, name, address, contact numbers, employer details, job title, birthdate, date hired, paydays, exemptions claimed, and their employer's address and payroll phone number.

- List your dependents who live with you, including their ages and relationships to you.

- Document your bank accounts. Include the type of account, name of the institution, branch, account number, and balance details for all accounts, such as savings, loans, and certificates of deposit.

- Detail your credit cards, loans, and lines of credit. Include the name of the bank or credit card, their contact information, and relevant payment details.

- Describe your real estate property by providing the current address, assessed value, mortgage balance, credit limit, unpaid property tax, amount owed, and the name and contact information of the person or bank you pay.

- List your motor vehicle details, including year, make, license number, loan balance, and the name and contact information of the lender.

- Document any additional assets you own or are currently purchasing by describing each asset and its current value.

- Indicate your sources of income by providing proof, attaching necessary documents such as bank statements and pay stubs from the last two months for yourself and your spouse/RDP, as well as detailing any pension or Social Security payments.

- List your monthly expenses, identifying the reasonable costs associated with your living situation. Include categories such as mortgage or rent, groceries, utilities, transportation, healthcare, insurance, tax payments, and any other relevant expenses.

- Sum up your total monthly expenses and propose a payment plan to the Oregon Department of Revenue, indicating what day of the month you can pay.

- Provide any additional information regarding expected changes to your income or health and detail any past financial issues.

- Sign and date the form at the authorization section, certifying the truthfulness of your statement.

- Submit the completed form to the address provided for the Oregon Department of Revenue ensuring all sections are filled correctly.

Complete your Oregongov statement of financial condition form online today to ensure timely assistance with your financial requirements.

Related links form

Claiming 0 or 1 on your state taxes hinges primarily on your financial circumstances. If you prefer having less tax withheld, claiming 1 may suit you, but be cautious as it could lead to tax liability. It’s a great practice to review your past filings and use resources like the Oregongov Statement Of Financial Condition For Individuals Form for a clearer picture of your situation. Making informed choices will lead to better financial health.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.