Loading

Get National Insurance Contributions Deferal Ca72b Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the National Insurance Contributions Deferal Ca72b Form online

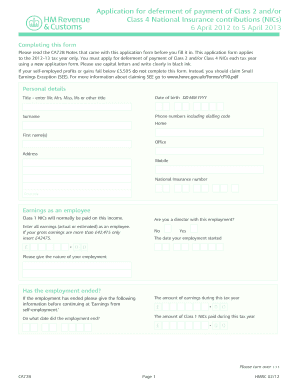

The National Insurance Contributions Deferal Ca72b Form is a crucial document for self-employed individuals seeking to defer their National Insurance contributions for a specific tax year. This guide provides step-by-step instructions to help users effectively complete the form online.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide your personal details at the top of the form. This includes your title, date of birth, surname, first name, contact phone numbers, National Insurance number, and postcode. Ensure all information is accurate and clearly entered.

- Enter your earnings as an employee. Specify if you are a director and include actual or estimated earnings up to £42,475. Additionally, provide the start date of your employment and the nature of your job.

- If applicable, indicate if your employment has ended and specify the end date and total earnings during this tax year, along with any Class 1 NICs paid.

- Next, provide your self-employment earnings. List your Self Assessment tax reference number, actual or estimated earnings, and the nature of your self-employment. If your profits fall below £5,595, refer to the information about Small Earnings Exception.

- Complete the declaration section by indicating if you authorize HM Revenue & Customs to deal with a third party and acknowledge your responsibilities regarding Class 4 NIC liabilities.

- Finally, sign and date the declaration. Ensure that the completed form is sent to the appropriate HM Revenue & Customs office at the address provided in the instructions.

Complete your National Insurance Contributions Deferal Ca72b Form online smoothly and efficiently!

You can check your National Insurance by accessing your record through the HMRC website. Simply create an account to view your contributions and ensure everything is in order. Understanding your National Insurance status is vital for planning your retirement and filling in important forms like the National Insurance Contributions Deferral Ca72b Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.