Loading

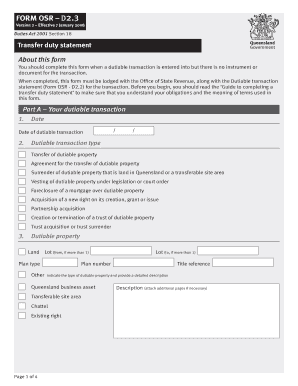

Get Transfer Duty Statement (form D2.3)office Of State Revenue, Qld

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Duty Statement (Form D2.3) Office Of State Revenue, Qld online

Filling out the Transfer Duty Statement (Form D2.3) is essential for documenting dutiable transactions in Queensland. This guide will provide you with clear, step-by-step instructions to help you complete the form online efficiently.

Follow the steps to complete your Transfer Duty Statement effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the date of the dutiable transaction in Part A, Question 1, by specifying the day, month, and year in the provided format.

- Select the type of dutiable transaction from the options provided in Part A, Question 2. Make sure to choose the correct option that accurately describes your transaction.

- In Part A, Question 3, specify the dutiable property involved in the transaction. Provide all relevant details, including land lot information and a comprehensive description.

- Complete the transferor details in Part B. Provide names, addresses, and ABN information for all transferors associated with the transaction.

- Proceed to Part C and fill in the transferee details for each transferee involved in the transaction, ensuring you provide their names, addresses, and ABN where applicable.

- Indicate the ownership share acquired by each transferee in Part C, Question 7 by entering the fraction that represents their interest in the property.

- In Part D, answer whether any of the transferors are related to any of the transferees in Question 10. Be prepared to provide evidence if applicable.

- Complete Question 11 regarding the dutiable value, and provide the necessary details about the consideration and unencumbered value of the property.

- In Part D, Question 12, offer a description of any other dutiable transactions that may be connected to this transaction.

- Finally, complete the verification section in Part E to affirm that the information provided is accurate and true. Ensure at least one party to the transaction signs and dates the form.

Start completing your Transfer Duty Statement online today to ensure compliance with Queensland's duties obligations.

To email the Queensland Revenue Office, visit their official website for the correct contact email address. Make sure to include all relevant details in your message, such as your query and any necessary identification. If your inquiry relates to a Transfer Duty Statement (Form D2.3) Office Of State Revenue, Qld, specify that to receive a more directed response.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.