Loading

Get Ct23 Short Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct23 Short Form online

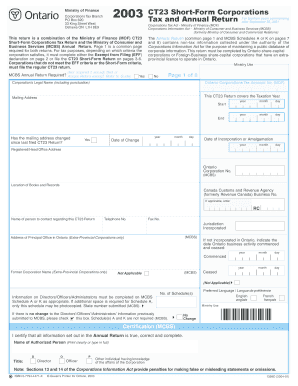

The Ct23 Short Form is a vital document required by corporations operating in Ontario for tax and annual reporting. This guide provides comprehensive, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to successfully fill out the Ct23 Short Form online.

- Click the ‘Get Form’ button to obtain the Ct23 Short Form and open it in your preferred online editor.

- Fill out page 1 of the Ct23 Short Form. Include the corporation’s legal name, mailing address, Ontario Corporations Tax Account number, and the dates marking the start and end of the taxation year.

- Indicate whether the mailing address has changed since the last return. If so, provide the date of change and the date of incorporation or amalgamation along with the location of your books and records.

- For tax purposes, determine if the corporation qualifies for the Exempt From Filing (EFF) status on page 2. If eligible, complete the EFF declaration; otherwise, move to the next sections of the form.

- Proceed to fill in the income tax details in page 4, ensuring to report the corporation's gross revenues, total assets, and any applicable tax credits.

- Complete pages related to specified tax credits on page 5, providing detailed information about credits for cooperative education or graduate transitions, if applicable.

- Conclude by reviewing all the information entered in the form. Save your changes, and then download, print, or share the form as needed.

Complete your Ct23 Short Form online today to ensure timely compliance with Ontario tax laws.

After the October 15 tax deadline, you may face penalties for late submissions if you did not file your Ct23 Short Form on time. The IRS may also assess interest on any unpaid taxes. It's essential to address any outstanding issues promptly to avoid additional complications. If you need assistance, platforms like uslegalforms can provide the resources and support to navigate your tax requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.