Loading

Get Challan 281 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Challan 281 Fillable online

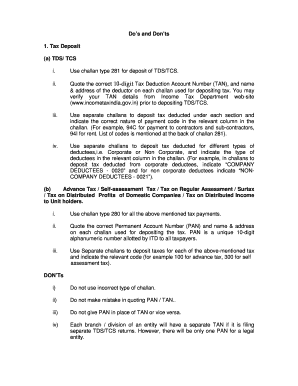

Filling out the Challan 281 is an essential process for the deposit of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). This guide provides a clear, step-by-step approach for users to complete the Challan 281 Fillable online, ensuring accuracy and compliance.

Follow the steps to fill out the Challan 281 Fillable online.

- Click ‘Get Form’ button to access the Challan 281 Fillable. This allows you to download and open the form for completion.

- In the first section, enter the 10-digit Tax Deduction Account Number (TAN) accurately. Ensure that this is verified against the Income Tax Department’s records to avoid errors.

- Provide the name and address of the deductor. Ensure that this information is complete and matches existing records.

- Select the appropriate nature of payment code in the designated column. Use separate challans for different types of payments to accurately track your tax deposits.

- Indicate whether the deductees are corporate or non-corporate in the relevant fields. This is crucial to ensure that the tax is recorded properly.

- Carefully verify all entered information, ensuring there are no typos or inaccuracies that could result in processing delays.

- After completing all fields, you can save changes, download the challan, print it for your records, or share it as needed.

Complete your documentation online to ensure timely and accurate compliance with tax obligations.

To make a correction in your challan, access the Challan 281 fillable form again and locate the specific details that need amending. After updating the information, resubmit the challan for correction. Always remember to retain a copy of the revised challan for your documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.