Loading

Get Form Cg1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cg1 online

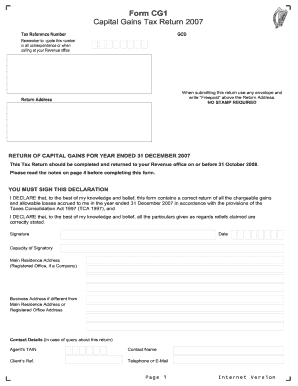

Filling out the Form Cg1 online can be straightforward with the right guidance. This guide will provide you with step-by-step instructions, ensuring that you complete the form accurately and efficiently.

Follow the steps to complete Form Cg1 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your Tax Reference Number in the designated field. Ensure that you quote this number in all correspondence related to your return.

- Review the section titled 'Return of Capital Gains for year ended 31 December 2007' and ensure you understand the requirements before proceeding.

- Complete the declaration section. You must sign to confirm that all information is correct regarding chargeable gains and allowable losses.

- Fill in your main residence address and, if applicable, provide your business address if it differs from your main residence.

- Provide contact details for queries regarding your return, including a contact name and telephone or email.

- Start entering details of assets disposed of during the year. Identify each type of asset in the relevant sections (e.g., shares, agricultural land, commercial premises) and enter the corresponding values.

- Specify if any disposals occurred between connected persons or at other than arm's length, by checking the appropriate boxes.

- Document any claims to reliefs that apply, such as those related to a principal private residence or retirement relief, and enter the amounts in the provided fields.

- Calculate chargeable gains and any losses, utilizing the relevant categories from the form. Ensure to input the amounts correctly for net chargeable gains.

- Finally, review all entries for accuracy. Once completed, save your changes, download or print your form, or share it as necessary.

Complete your Form Cg1 online today to ensure timely submission and compliance.

Related links form

To avoid capital gains tax on property in Ireland, consider holding onto the property for longer periods or investing in property enhancements that increase its value. Utilizing tax reliefs and exemptions can also be beneficial. Resources like Form Cg1 can guide you through the implications of property sales and your tax liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.