Loading

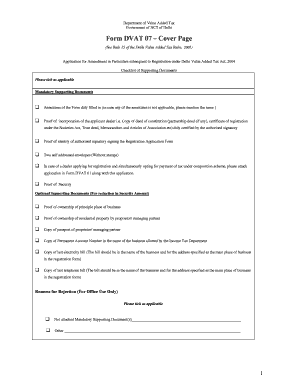

Get Online Fill Of Dvat 07 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Online Fill Of Dvat 07 Form online

The Online Fill Of Dvat 07 Form is essential for individuals and businesses in Delhi looking to make amendments to their registration details under the Delhi Value Added Tax Act. This guide will provide you with a clear, step-by-step approach to successfully filling out the form online.

Follow the steps to fill out the Online Fill Of Dvat 07 Form effectively.

- Press the ‘Get Form’ button to access the Online Fill Of Dvat 07 Form and open it in your preferred editor.

- Begin by entering your Registration Number in the designated field. Ensure this is completed accurately as it identifies your existing registration.

- Provide your Full Name as the Dealer, ensuring you input your first name, middle name (if applicable), and surname in the correct order.

- In the Amendment Summary section, specify the fields you wish to amend, the date of these amendments, and the reasons for the changes. Additional sheets may be attached if needed.

- Complete the fields for the Full Name of the Applicant Dealer, Trade Name (if any), and Nature of Business. You may tick all applicable options in the Nature of Business section.

- Select the Constitution of the Business from the provided options by ticking the appropriate box. This includes categories like Proprietorship, Private Ltd. Company, etc.

- Indicate the Type of Registration you are applying for by ticking either Mandatory or Voluntary, and if opting for the composition scheme, mark 'Yes' or 'No' accordingly.

- Fill in the Annual Turnover Category, selecting the appropriate option based on your turnover from the previous fiscal year.

- Provide your Permanent Account Number (PAN) and any Central Excise Act Registration Number if applicable.

- Input the Principle Place of Business information, including the complete address, email, and contact details.

- If your address for service of notices differs from your principal place of business, fill in the address details in that section.

- Complete the additional places of business information, if applicable, including the number of such places.

- Provide details of your main bank account including the Account Number and Name of Bank.

- List the top five items that are primarily dealt with in your business, ranked from highest to lowest volume.

- Indicate the Accounting Basis you are using and the Frequency of filing returns, tick the applicable boxes.

- Complete the Security section, if modifications to your security amount are needed. Fulfill any further details concerning the type and expiry date of the security.

- In the 'Details of investment in the business' section, fill in all required financial information accurately.

- Sign the Verification section, confirming that all provided information is correct. Ensure it is signed by the authorised signatory with full details.

- Once all fields are filled, review the form thoroughly for any errors before finalizing.

- You can then save changes, download the form, print it for your records, or share it as required.

Begin the process now by filling out the Online Fill Of Dvat 07 Form.

Filing VAT returns online is made easier through platforms that offer the Online Fill Of Dvat 07 Form. Access a reliable service and provide your transaction details as prompted. It's essential to verify all information before finalizing your submission. This method not only streamlines the process but also reduces the chances of errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.