Loading

Get Pers Form 459 462

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pers Form 459 462 online

Filling out the Pers Form 459 462 online can be straightforward when you follow the right steps. This guide will walk you through the necessary sections of the form, ensuring you understand each part before submitting your application.

Follow the steps to successfully fill out the Pers Form 459 462 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

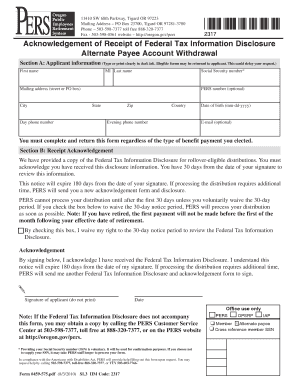

- Complete Section A with your personal information. This includes your first name, middle initial, last name, social security number, mailing address, city, state, zip, and country. Ensure all entries are clear and legible to avoid processing delays.

- Fill in your day and evening phone numbers along with your date of birth in the mm-dd-yyyy format. Providing an email address is optional.

- In Section B, acknowledge that you have received the Federal Tax Information Disclosure. You have 30 days to review this information before your distribution can be processed.

- If you wish to waive the 30-day notice period for processing your distribution, check the provided box before signing.

- Ensure you sign and date the form at the designated area. Your signature confirms you have received the information and understand that it will expire after 180 days.

- After completing the form, review all sections to confirm there are no errors or omissions before submitting. You may then save changes, download, print, or share the finished form.

Complete your Pers Form 459 462 online today for a seamless experience.

Yes, retirement income from Oregon PERS is generally considered taxable by both federal and state authorities. This means that you should plan accordingly to ensure proper tax withholding and management of your finances. For personalized assistance with your tax situation, forms like the Pers Form 459 462 can be quite helpful in navigating any complexities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.